2023.12.29 新加坡汇款到中国账户被冻结的风波燃烧多月,有受害者更怀疑汇款公司涉及洗钱欺诈,导致他们的汇款被中国冻结,不过金管局和警方发表联合文告强调,未收到消息指汇款公司涉及洗钱或欺诈。当局也说,已联络中国政府为受害者提供帮助。

金管局和警方今天(29日)发布联合文告表示,对日益增加的账户冻结事件表示关注。但目前,无法确定账户的冻结与汇款公司涉嫌洗钱案活动有所关联。

近期,有不少在新加坡工作的外国人反映,他们通过汇款公司将钱汇回中国的银行账户后,却发现账户被中国当局冻结,原因是涉及犯罪行为,如网络赌博、电信诈骗等。

这一事件引起了广泛的关注和担忧,许多受害者也到汇款公司讨要说法。针对这一情况,新加坡金管局和警方于12月29日发布了联合文告,澄清相关的事实和措施,为公众提供指引和帮助。

附:新加坡金管局与警方联合回应《加强汇兑业务监管》函

Monetary Authority of Singapore, Published Date: 29 December 2023

Joint Response to Letter “加强汇兑业务监管”- Lianhe Zaobao, 16 December 2023 by MAS and SPF

We thank Mr Gong Yu Cheng (“加强汇兑业务监管”) for his letter of 16 Dec.

2. The Monetary Authority of Singapore (MAS) and the Singapore Police Force (SPF) share Mr Gong’s concern about the increasing incidence of funds being frozen in beneficiaries’ bank accounts in China, after being remitted through licensed remittance companies in Singapore.

3. However, it is not clear that the freezing of the remitted funds in China was motivated by concerns of money laundering by these remittance companies, as Mr Gong seems to suggest.

4. In fact, MAS and SPF have not received information showing that the remittance companies were involved in money laundering or scams, or that the funds were frozen because the remittance companies had processed the proceeds of money laundering or scams in Singapore. Should there be information to suggest otherwise, MAS and SPF will take appropriate regulatory or enforcement action.

5. Companies providing remittance services are licensed by MAS and required to meet the same standards of anti-money laundering controls as other regulated financial institutions.

6. In the provision of their services, remittance companies may pass the funds to intermediary institutions, based in Singapore or overseas, for the onward transmission of the funds to the beneficiaries. These intermediaries include banks, operators of card payment systems, or third-party agents. The remittance companies are required to conduct due diligence on the intermediary institutions with which they work.

7. The currently reported cases of frozen funds in beneficiary accounts in China concern remittances that had been processed through overseas third-party agents. This is a common and accepted mode of remittance offered by remittance companies to keep transaction costs low for customers, and has been around for decades.

8. MAS’ direction to licensed remittance companies in Singapore to suspend the use of non-bank and non-card channels when transmitting money to persons in China from 1 January to 31 March 2024 is aimed at minimising risks to remitters and not related to any specific money laundering concern.

9. In the meantime, the Singapore Government has been asking the PRC Government to help affected remitters understand how they can get their accounts and monies in China unfrozen by the PRC law enforcement agencies. MAS and SPF had also organised an outreach session on 18 December 2023 for affected remitters. The PRC Embassy in Singapore and the three remittance companies whose customers had been affected by the remittance problem also attended this outreach session.

10. MAS and SPF continue to monitor the situation closely.

Lu Xinyi

Director (Corporate Communications)

Monetary Authority of Singapore

Assistant Commissioner of Police (AC) Ho Yenn Dar

Director (Covering)

Public Affairs Department

Singapore Police Force

2023.12.23 与28亿洗钱案被告有关联 富商和两合伙人仓促离新

28亿洗钱案爆出新进展,与被告王德海有关联的一名富商和其两名合伙人,在案件曝光后的第二个月已经仓促离开新加坡。

本地警方日前侦破本地最大宗的洗钱案,共九男一女被控,其中包括34岁的王德海。

根据控状,王德海被指使用犯罪所得款项来购买The Marq豪华公寓。调查显示他曾在2012年被招聘参与菲律宾的线上赌博生意,违法为中国客户提供远程赌博服务,并在2016年10月得知自己被中国当局通缉。为了不被判刑,他决定移居新加坡。

根据《海峡时报》 报道,在本地做生意的富商苏炳海(译音)被发现与王德海有关联。

苏炳海的公司推荐王德海加入圣淘沙高尔夫俱乐部,两人有生意往来。他与另一名涉案男子王斌刚的同居女子王丽云有关联。王斌刚在菲律宾靠创办网络赌博平台发家,前年他和本案被告王水明曾注资台湾科技公司。

根据报道,洗钱案8月底曝光后,苏炳海的两名合伙人苏福祥与苏炳旺也受到警方关注。凑巧的是,无论是苏炳海、苏福祥与苏炳旺,今年9月之后都已经消失踪影。

As Singapore Police Probe Money Laundering Ring, a Private Equity Entrepreneur Disappears

by Martin Young, Tom Allard, Yan Yan (OCCRP), and The Straits Times

22 December 2023

The founder of an Asian private equity firm has disappeared from his Singapore home and workplace as police sought to question him in connection to an alleged $2-billion money laundering ring busted in August this year, a Straits Times/OCCRP investigation has found.

Su Binghai, an entrepreneur of Chinese origin, is a “person of interest” in an ongoing investigation into the alleged laundering ring, a source familiar with the case told the Straits Times.

The source, who spoke on condition of anonymity, did not provide further details. Su Binghai has not been formally named as a suspect, which does not happen in Singapore until after an arrest.

Corporate registry data shows that Su Binghai founded the private equity outfit New Future International in 2017. He became a co-owner of the firm the following year along with Wang Dehai, one of 10 people arrested by Singapore police during the bust on August 15.

Two other New Future International directors, Su Bingwang and Su Fuxiang, are also “persons of interest,” said the source, without adding details. (It is not clear if the three Sus are part of the same family, but the three often cited the same residential address in their Hong Kong corporate filings.)

None of the Sus could be reached for comment.

Singapore’s August raids on the alleged money laundering ring sent shockwaves through the country’s political elite, and have raised questions about how lax regulations and an easily exploited residency program have contributed to a flood of dirty money into the Southeast Asian financial hub. Most of those arrested lived in upmarket areas, and many belonged to prestigious golf clubs.

Headquartered in Hong Kong, Su Binghai’s New Future has a Singapore-based offshoot and multiple subsidiaries. The company maintains offices in both cities and its website showcases a portfolio of countries and industries in which the company says it invests, though it does not provide details and reporters could find no public record of any specific investments it has made. Police have not said that New Future is subject to investigation.

The owners of New Future have been obscured since 2019, when its ownership entity was shifted from Hong Kong to the British Virgin Islands, a tax haven with high levels of corporate secrecy.

Su Binghai, who remains a director of New Future, holds multiple passports and an entree into elite social circles in Hong Kong and Singapore. He, Su Bingwang, and Su Fuxiang, each own tens of millions of dollars worth of property around the world.

When a Straits Times reporter visited Su Binghai’s Singapore residence this month, a domestic worker said that more than 10 uniformed police had visited the property in September, just weeks after the raids, looking for her employer. But Su Binghai and his wife had already left the home and did not say where they were going or when they would return, she added. The worker identified Su Binghai from a photo and confirmed he was her boss.

Su Binghai’s Singapore residence

Credit: The Straits Times

Su Binghai’s Singapore residence.

Another domestic worker answered the phone at a Dubai number registered to Su Binghai, and told OCCRP that “Mr Su” was not there. She was unable to provide information on his whereabouts.

Like Su Binghai, the two other New Future directors suddenly left their Singapore homes and workplaces in September, two colleagues and a neighbor told the Straits Times. (Singapore’s police did not respond to requests for comment about the Sus’ links to Wang Dehai or whether they had left the country.)

The plush home of one of the company’s directors, Su Bingwang, is located on Singapore’s Rochalie Drive, close to embassies and other grand homes. When the Straits Times visited this month, it was empty.

A neighbor confirmed that a Su Bingwang had lived there for about a year, and added that movers had turned up in September to remove items from the home. The home is currently being advertised on real estate websites as a rental for $33,800 per month.

When the Straits Times visited New Future’s Singapore office on December 1, a staff member asked unprompted if the reporter was there about “the money laundering case.”

“Is this about the Sus? I am not sure they will want to speak to you,” the employee added.

The staff member, who asked not to be identified, confirmed that Su Binghai and Su Fuxiang were involved in the firm and were frequent visitors to the Singapore office, but hadn’t been seen there “for a while.”

On a second visit on December 13, the employee affirmed that both men worked at the Singapore office, adding they had not been seen since September. The employee declined to respond to questions about where the two were.

New Future International did not respond to questions about the Sus and its operations. Wang Dehai’s lawyer did not respond to questions.

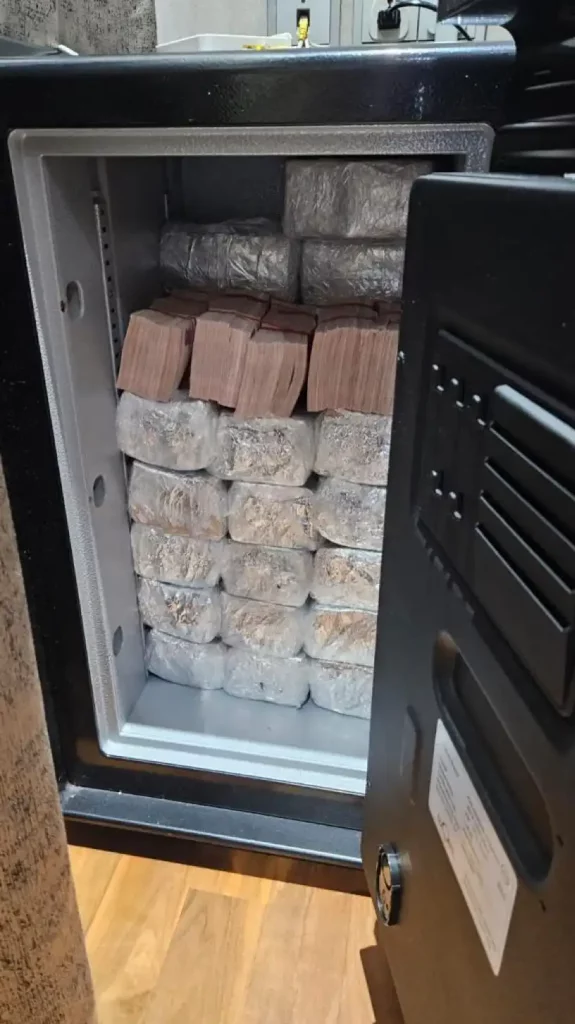

More than 150 properties have been confiscated by Singapore authorities in connection with the crackdown on the alleged money laundering ring so far. Some 68 gold bars, cryptocurrencies, millions in cash, 546 pieces of jewelry, and 62 vehicles were also impounded during the raids.

Online, Then on the Run

Even before he fell afoul of Singapore authorities, Wang Dehai was a wanted man. In February 2018, Chinese authorities published an arrest warrant alleging he was involved in illegal gaming.

Along with Wang, two others arrested in Singapore in August had a background in online gaming. According to authorities, this was not a coincidence: A large amount of the funds laundered in Singapore, police said, was generated by online casinos and telecommunications scam factories.

Southeast Asia is in the midst of a lucrative cybercrime spree, much of it targeting Chinese citizens. China’s Ministry of Public Security has estimated illegal gambling by mainland Chinese amounts to 1 trillion yuan a year, or about $140 billion.

The scam and online casino industry in Cambodia alone has been estimated to be worth between $7.5 billion and $12.5 billion a year, Jeremy Douglas, head of Southeast Asia operations at the United Nations Office on Drugs and Crime, told OCCRP.

Wang was at the forefront of the online gambling revolution in the region, working in the Philippines between 2012 and 2016, according to media accounts of court testimony he has given since his arrest. The industry was legal in the Philippines but, because the casinos targeted bettors in China where gambling is illegal, he was breaking Chinese laws.

Just a few months after Wang’s 2018 Chinese arrest warrant was publicized on police social media accounts, he and Su Binghai incorporated a company called Yuen Zheng Holding Limited, splitting ownership equally, Hong Kong corporate registry data shows.

That same year, Yuen Zheng took over 100 percent of the shares of New Future International Limited, the private equity firm which Su Binghai had founded a year earlier.

In 2019, New Future was again taken over by another company registered in the British Virgin Islands: “Yuan Zheng Holding Limited,” which is spelled exactly the same as the Hong Kong entity’s Chinese characters in standard pinyin transliteration. Because of the territory’s corporate secrecy rules, it was not possible to determine who owns Yuan Zheng. (Su Binghai and Wang Dehai’s Hong Kong-based company, Yuen Zheng, was dissolved in 2021.)

Despite the change of the ownership entity, the three Sus remain directors of New Future, according to a 2023 corporate filing in Hong Kong. Singapore corporate records also show Su Binghai and Su Fuxiang are the majority shareholders of New Future’s Singapore subsidiary. Su Binghai, meanwhile, features prominently on New Future’s corporate website, where he is pictured sitting at the center of a group of suited professionals.

Su Binghai seated at center of screenshot taken from website

Credit: New Future International

Screenshot of New Future International’s website showing Su Binghai seated at center.

New Future’s Singapore arm also nominated Wang Dehai for membership of the deluxe Sentosa Golf Club, according to a list of defaulting members reviewed by the Straits Times this month.

The three Sus are all natives of Anxi County, an inland mountainous area of Fujian province on China’s southeastern coast. Otherwise known only for its tea plantations, Anxi has become a hotbed of online scams and illegal gambling.

The Sus also hold multiple passports. All three are citizens of Cambodia, and at least two — Su Binghai and Su Fuxiang — hold citizenship of the Caribbean nation of St. Kitts and Nevis. Su Binghai also listed a Vanuatu passport in the documents seen by reporters.

They have used these citizenships to set up dozens of companies in Hong Kong and Singapore. Many of those in Hong Kong reported just one Hong Kong dollar in registered capital, the minimum required to set up a company.

Sudden Rise of the Sus

New Future does not publish financial results, but boasts on its corporate website that “the Founding Partners have, separately or jointly as co-investors, made over $2 billion of private equity investments in Greater China during the five-year period prior to founding New Future.”

The website also lists a portfolio of industries — including “Environmental Material Technology and Applications,” “Digital Mobile Payment Service,” and “VR Immersive Solutions” — in which it says it invests in Hong Kong, China, Singapore, and Indonesia. But it does not provide details of those investments and reporters could find no evidence of them in public records.

In Hong Kong company registries, the three Sus list high-end residential addresses as their correspondence addresses. In Singapore, the last known addresses for both Su Binghai and Su Bingwang were ultra-luxury bungalows — Su Bingwang’s just a stone’s throw from embassies and the Ministry of Foreign Affairs.

Su Bingwang’s Singapore residence

Credit: The Straits Times

Su Bingwang’s Singapore residence.

Su Binghai bought a Hong Kong luxury flat for $13.8 million in late 2017. In the U.K., Su Binghai is also listed as the founding shareholder of two active holding companies, Su Empire Limited and Su Group Limited.

The three Sus also appear to have splashed out significant sums on prestige and personal status.

Rubbing shoulders with Hong Kong’s elite at the Hong Kong Jockey Club, Su Binghai is listed as a registered member of “Gin,” “Happy Mission,” and “The Easy Ride” –– syndicates that offer joint ownership of racehorses.

In Singapore, the Sus are members of at least one expensive golf club and have been top donors to several charitable causes, including a 2022 golf event organized by the Singapore Disability Sports Council.

Su Fuxiang helped sponsor a classical music concert in May attended by the country’s deputy prime minister, Heng Swee Keat, in the prestigious Esplanade Hall. The concert, held by the Orchestra of the Music Makers, would make Singapore a “more refined, sophisticated and vibrant place to live,” Su Fuxiang said in the program notes.

A spokesperson for the charity said Su Fuxiang had cleared its due diligence process.

“He said he was keen to set up a foundation to increase his contributions to the community after settling down with his family in Singapore for more than three years,” he said.

Orchestra of the Music Makers is in the process of lodging a precautionary suspicious transaction report regarding the donation, the spokesperson added.

2023.12.15 涉28亿元洗钱案 以监狱无法提供适当医疗照顾和患癌风险为由 苏宝林再度申请保释被拒

根据辩方陈词,苏宝林患有紫绀型先天性心脏病。他在2023年7月4日进行体检时,发现有很高的患胃癌风险,建议他看肠胃科医生,并考虑进一步做胃镜检查。辩方指出,苏宝林12月11日才在监狱的安排下,到樟宜综合医院见专科医生,且前后不超过五分钟。苏宝林至今仍未接受胃镜检查,说明监狱无法为被告提供足够和适当的照顾。当法官询问律师是否有医学报告说明苏宝林须要立刻接受胃镜检查,律师回应说:“若有患癌风险就该检查,这是常识。已有很多人因癌症过世,我们不应该冒险,也不应以被告的生命做赌注。”律师也指,被告住家与最近医院的距离,要比监狱与最近医院的距离来得短,将苏宝林从监狱带出来还得至少多花五分钟。然而,被问及有无证据证明这是生死攸关的五分钟时,律师答道:“没有,但我知道有人在五分钟内去世。”

控方则回应,监狱署在得知苏宝林的情况后,已安排将他还押在樟宜医疗中心而非普通牢房,24小时有医护人员照看,且苏宝林的病情没有严重和特殊到需要获得保释。至于苏宝林的患癌风险,监狱也已安排他到樟宜综合医院看诊;关于监狱与医院的距离,当遇到须就医的紧急情况,监狱署会加快速度把囚犯送去医院。辩方没有任何证据显示从监狱送院会危及患者安全,苏宝林所称的缺乏所需药物也不属实。

Money laundering suspect Su Baolin allegedly made millions from illegal gambling sites in Myanmar

UPDATED 2023年12月15日 下午11:03 SGT

SINGAPORE – Money laundering suspect Su Baolin was allegedly involved in operating illegal gambling websites based in Myanmar, with the police saying he made $5 million to $6 million from these sites between 2020 and 2022.

Commercial Affairs Department (CAD) officer Louis Tey Jijie said in an affidavit that Su helped run these sites between 2019 and 2023, and purportedly received his earnings in the form of cryptocurrency.

These sites targeted users in Brazil and China.

This is the first time links have been drawn between gambling sites based in Myanmar and one of the 10 foreigners arrested on Aug 15 in an anti-money laundering probe which saw the police seize $2.8 billion in cash and assets.

The claims were made in court on Dec 15 at Su’s second attempt to be granted bail.

His first application was denied on Sept 6.

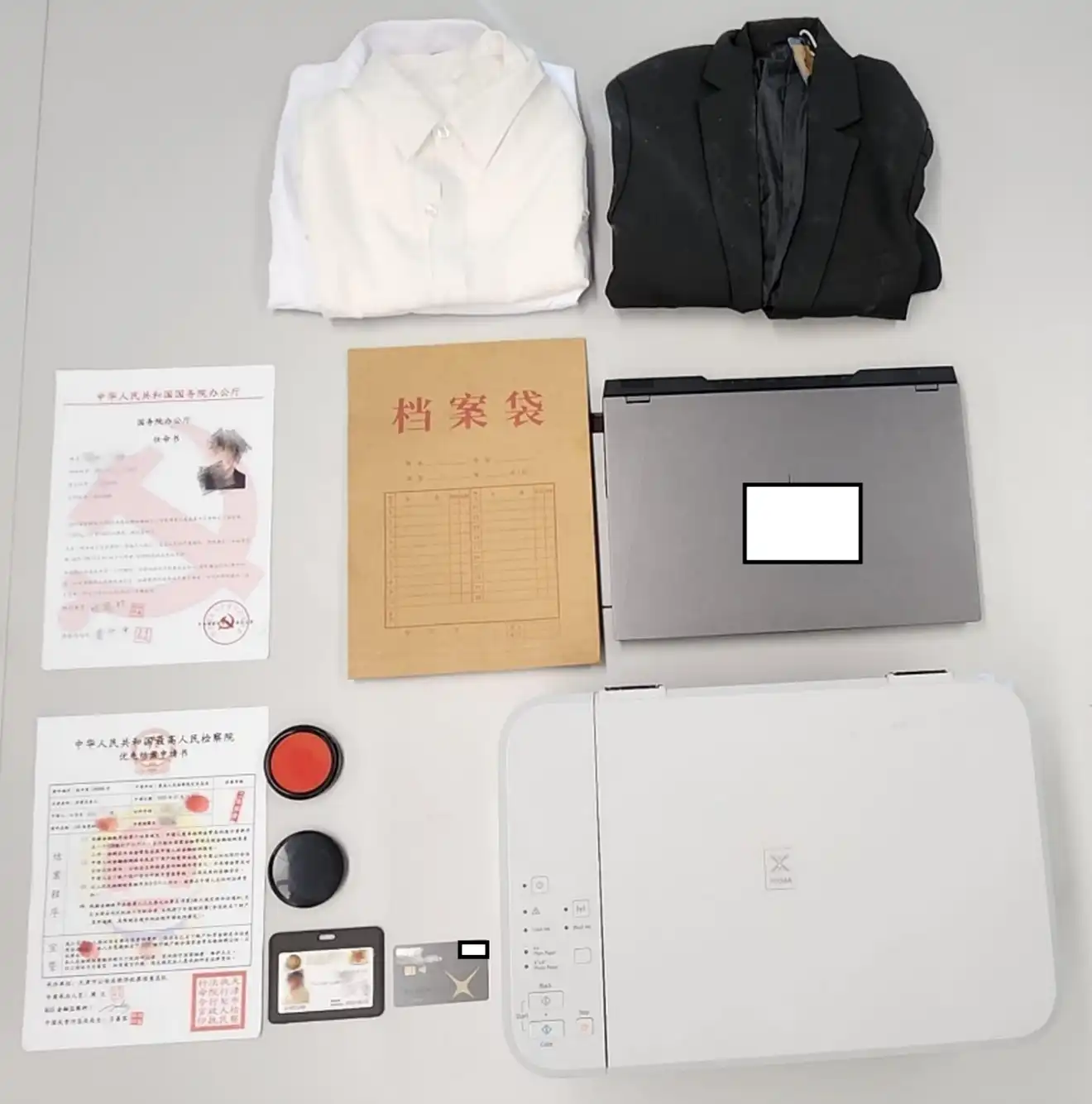

Su faces two charges – one for allegedly using a forged document to show he was the executive director of an import-export company, and a second in which he is said to have conspired with former Citibank employee Wang Qiming to make a false document with the intention to cheat Standard Chartered Bank.

The affidavit also revealed that Wang Qiming was investigated by CAD for the forgery-related offences from October 2021, and subsequently arrested. He has been on bail since Nov 16, 2021.

The Government had in October 2023 revealed that money laundering investigations started in 2021, after the authorities became aware of the use of suspected forged documents to substantiate sources of funds in bank accounts in Singapore.

Su was called in to give a statement in relation to the forgery claims in 2021. Mr Tey said that despite the scrutiny, Su allegedly continued to be involved in illicit activities.

In arguing against granting him bail, Mr Tey said the accused is a flight risk as he allegedly holds undisclosed assets abroad and has the means to abscond if released on bail.

The CAD officer said that from early 2023, Su had been directing an individual, “Person A”, allegedly based in Dubai, to transfer cryptocurrency worth more than $5 million into various wallets, some of which were provided by “Person B” – one of Su’s associates.

The associate is said to have then assisted Su to convert the cryptocurrency to physical fiat, a government currency, or make payments via bank transfers on Su’s behalf for his expenses, Mr Tey added.

The CAD officer said: “Within this year, Person B assisted Su to convert approximately $4.7 million worth of cryptocurrency to physical fiat or to make payments on the accused’s behalf in Singapore.”

He added that it demonstrates Su allegedly has means to bring monies from suspicious sources into Singapore.

“His lack of candour on this gives rise to a strong suspicion that there are more instances of such fund movements,” added the investigator.

Mr Tey also pointed out that in Su’s submissions to the court, the accused referred to his condominium in Xiamen, worth $2.1 million, as “pittance to sustain him and his family in the long run”.

“The fact that the accused would refer to $2.1 million as mere ‘pittance’ adds to my belief that he continues to hold undisclosed assets abroad,” said the CAD officer.

During the hearing on Dec 15, Deputy Public Prosecutor Ng Jean Ting told the court the police are considering more charges against Su for money laundering, forgery and falsification of accounts.

The DPP said, citing Mr Tey’s affidavit, that the police have uncovered more instances of forged documents being submitted to banks by Su to explain his sources of wealth.

She added: “The police are looking into the financial statements of one of Su’s companies, Xinbao Investment Holdings, and found that its financial statements and income tax returns are likely falsified to give the impression that the company is profitable.”

In arguing for Su to be released on bail, defence lawyer Sunil Sudheesan said Changi Prison is not able to meet his client’s medical needs.

He said that no gastroscopy has been done for his client more than three months since Su was found to be at high risk of gastric cancer.

Mr Sudheesan said: “A medical report (on Su’s cancer risk) was given to the prosecution on Aug 23. Since then, all the follow-up given to my client is a five-minute appointment with a Changi General Hospital (CGH) gastroenterologist on Dec 11.

“If it were any one of our relatives, we would have been insistent on an early gastroscopy. I am not mincing my words when I say that SPS (Singapore Prison Service) is gambling with the accused person’s life.”

The defence lawyer added that his client, who has congenital heart disease, was not given oxygen therapy on Oct 10 even though his oxygen saturation level fell to 84 per cent.

In response, DPP Ng said that while Su is at risk of gastric cancer, he does not currently suffer from an advanced stage of the disease.

She said: “There is no affidavit from the accused or his doctors to show the immediate need for a gastroscopy.

“Su has been seen by a specialist in CGH, and there is nothing to suggest that the doctor was negligent or flippant in his review of the accused.”

As for the allegations on oxygen therapy, DPP Ng cited an affidavit by SPS chief medical officer Noorul Fatha As’art which states that Su’s oxygen saturation level was recorded at 86 per cent on Oct 9 and Oct 10.

“The need for oxygen therapy did not arise as the accused’s oxygen saturation did not fall below 85 per cent,” the DPP said.

DPP Ng added that Su is being housed in a medical centre, where his vital signs are monitored regularly and he has access to a bedside call bell.

The defence argued that the prosecution had overstated the seriousness of Su’s alleged offences, as the CAD’s investigations since 2021 found “only around $4.7 million (out of the $90 million seized from Su and his wife) allegedly came from an illegal source”.

DPP Ng responded, saying that the CAD is continuing to investigate the seized assets.

As for why former Citibank employee Wang Qiming, who is mentioned in one of Su’s charges, was granted bail, the prosecution said Wang does not appear to have substantial assets at his disposal or affluent foreign connections who may help him abscond.

At the end of the hearing, District Judge Brenda Tan denied Su bail.

She said the accused is a serious flight risk, and there is a risk of collusion between Su Baolin and Su Haijin, another suspect in the money laundering case.

The judge added that she is satisfied the SPS is able to manage Su’s medical conditions safely, and that his conditions are not “exceptional” so as to justify granting bail.

Singapore S$2.8b money laundering case: Suspect with ‘high cancer risk’ denied bail a second time

Saturday, 16 Dec 2023 8:37 AM MYT

SINGAPORE, Dec 16 — One of 10 suspects in a S$2.8 billion (RM9.8 billion) money laundering case has been denied bail a second time as the police presented new allegations he obtained millions of dollars from Myanmar-based illegal gambling websites.

Following an adjournment sought by the prosecution on November 15, Su Baolin returned to court via video-link yesterday where he renewed claims he faces a high risk of gastric cancer.

Su, 42, is facing two charges for allegedly using forged documents to commit fraud.

The prosecution sought the adjournment of Su’s bail review on Nov 15 so it could review the defence’s submissions and to file affidavits, if required, over accusations raised in relation to Su’s health treatment.

The allegations were mainly focused on whether Singapore Prison Service (SPS) could provide adequate care for Su whose counsel claims he faces a “high risk” of gastric cancer.

During the hearing yesterday, defence counsel Sunil Sudheesan brought up a medical report which was submitted to the prosecution in August 2023 that recommended his client go for a follow-up gastroscopy.

Sunil said that he was under the impression that the gastroscopy would have been given to the accused but Su got only a five-minute check with a gastroentrologist.

“This is inadequate care — if it was any one of our relatives, we would have been insistent on the gastroscopy.

“So I am not mincing my words when I say that prisons is gambling with the accused person’s life,” said Sunil.

Responding, Deputy Public Prosecutor (DPP) Ng Jean Ting argued that based on the affidavit of the SPS’ chief medical officer, the high risk of gastric cancer was known to them, and they had taken steps to address the medical issues.

“The (alleged) shortcomings are unfounded and do not constitute a material change in circumstances,” said DPP Ng.

She said that SPS would expedite the movement of inmates if necessary and that they remain in the care of medical professionals until they are in the hospital.

“There is nothing to suggest that it would compromise the safety,” added DPP Ng.

When District Judge Brenda Tan asked Sunil if there was any expert opinion to support the defence’s claim that Su was at a high risk of gastric cancer, he said that all he had was the doctor’s gastroscopy recommendation and “common sense”.

“We have lost many people to cancer so we shouldn’t take the risk and we shouldn’t gamble,” said Sunil.

The judge referred to a point in the defence’s submission comparing the time taken to travel from prison to Changi General Hospital (CGH) and from Su’s residence, should he be granted bail, to the National Heart Centre.

She asked Sunil about the relevance of this in a situation where Su would need to get “immediate medical help”.

Sunil clarified that he meant it would take five minutes longer to go from prison to SGH than from Su’s home to the National Heart Centre.

However, the judge reminded Sunil about the hospital’s processing and waiting time, and asked if he had any expert opinion on the five minutes being a matter of life and death.

Sunil responded: “No, but I have known people to die in five minutes.”

Additional charges likely to be tendered

DPP Ng also said that Su is likely to face additional serious charges based on material outlined in the investigative officer’s affidavit filed in court.

These relate to allegations that about US$4.7 million (S$6.25 million) was channelled into Singapore from overseas and more instances of forged documents that were submitted to the banks by Su.

This suggested that the financial statements and income tax returns for one of Su’s companies were likely to be falsified, DPP Ng said.

The affidavit also outlined allegations that Su had been involved in illegal gambling websites based in Myanmar that generated the funds channelled into Singapore.

In delivering her decision to decline bail, the judge agreed with the prosecution that the new facts presented by the investigative officer indicated that Su had far more substantial overseas assets than he has disclosed.

“This would add to his flight risk as he clearly has resources to relocate easily,” she said.

On the point of medical care, the judge said that SPS’ chief medical officer had detailed all the steps taken to ensure Su would be properly cared for.

“He is not placed in a normal cell but carefully housed at Changi Medical Centre where he has a bed and his vital signs are monitored by trained medical professionals with access to a bell when he needs medical assistance.”

Su is set to return to court on January 24, 2024 for a pre-trial conference. — TODAY

以患癌风险等为由 苏宝林再申请保释被拒

发布 /2023年12月15日 09:22 PM

苏宝林的代表律师以当事人有患胃癌风险为由再次申请保释,在庭上也针对监狱只安排被告见专科医生五分钟,而质疑当局是否为被告提供了足够照顾。

涉及28亿元洗钱案的被告苏宝林(42岁),通过柯吴律师事务所刑事部门主管苏呢尔(Sunil Sudheesan)在11月15日向法庭申请保释,但因控方须要时间回应,展期到星期五(12月15日)审理。

海外人士助移470万元加密货币到本地 法官:苏宝林有能力移居海外

法官发表决定时说,苏宝林的潜逃风险仍然存在,且警方进一步的调查显示,有海外人士协助苏宝林把价值470万元的加密货币转移到新加坡。这不仅说明苏宝林拥有的海外资产比他所说的多,有移居海外的能力,也提高了他的潜逃风险。

另外,监狱署医务长在宣誓书详细列出,自苏宝林还押樟宜医疗中心以来,为确保后者得到妥善医疗照顾所采取的措施。法官认为,监狱署有能力为苏宝林提供妥善的医疗照顾,最终驳回苏宝林的保释申请。

根据辩方陈词,苏宝林患有紫绀型先天性心脏病。他在2023年7月4日进行体检时,发现有很高的患胃癌风险,建议他看肠胃科医生,并考虑进一步做胃镜检查。

辩方指出,苏宝林12月11日才在监狱的安排下,到樟宜综合医院见专科医生,且前后不超过五分钟。苏宝林至今仍未接受胃镜检查,说明监狱无法为被告提供足够和适当的照顾。

当法官询问律师是否有医学报告说明苏宝林须要立刻接受胃镜检查,律师回应说:“若有患癌风险就该检查,这是常识。已有很多人因癌症过世,我们不应该冒险,也不应以被告的生命做赌注。”

律师也指,被告住家与最近医院的距离,要比监狱与最近医院的距离来得短,将苏宝林从监狱带出来还得至少多花五分钟。然而,被问及有无证据证明这是生死攸关的五分钟时,律师答道:“没有,但我知道有人在五分钟内去世。”

控方:病情没严重到得保释 若紧急监狱会加速送囚犯入院

控方则回应,监狱署在得知苏宝林的情况后,已安排将他还押在樟宜医疗中心而非普通牢房,24小时有医护人员照看,且苏宝林的病情没有严重和特殊到需要获得保释。

至于苏宝林的患癌风险,监狱也已安排他到樟宜综合医院看诊;关于监狱与医院的距离,当遇到须就医的紧急情况,监狱署会加快速度把囚犯送去医院。辩方没有任何证据显示从监狱送院会危及患者安全,苏宝林所称的缺乏所需药物也不属实。

调查也揭露,苏宝林涉嫌经营设立在缅甸、以中国和巴西赌客为主的非法线上赌博网站。2020年至2022年期间,苏宝林从中赚取500万至600万元的加密货币。

苏宝林也向查案人员称这笔资产从未流入新加坡,但调查显示,苏宝林曾安排他人替他把这笔非法所得的约470万元套现,或代表他在新加坡付款。

然而,辩方不同意查案人员在宣誓书指苏宝林对资金流动一事不坦诚。辩方称,苏宝林配合调查过程,查案人员的中文能力不强,在问话时对苏宝林的话有不同诠释,才认为他不坦诚。若苏宝林获得保释,辩方可安排自己的通译员,在调查时为警方提供协助。

控方也透露,警方在调查苏宝林其中一家公司的财务报表时发现,该公司的收入和应收账款疑被刻意夸大,以伪造公司盈利的假象。警方正考虑对苏宝林加控伪造文件、诈骗和洗钱等相关的罪名。

案件已展期明年1月24日进行审前会议。

2023.12.11 涉28亿元洗钱案还押四个月 张瑞金保释申请再被拒

法官发表决定时说,这是一起涉及多人的复杂案件,被告所面对的严重罪行,以及潜逃和串谋的风险仍然存在,最终驳回张瑞金的保释申请。

上个月申请保释时被控方指对法庭不坦诚,涉28亿元洗钱案被告之一张瑞金再次申请保释,声称被还押至今已四个月,但最终仍然被拒。

2023年9月18日,在还押中度过45岁生日的被告张瑞金,在案件上次过堂时改聘来自Eugene Thuraisingam律师事务所的律师为代表,他星期一(12月11日)通过新律师再度向法庭申请保释。

律师指出,法庭早前基于三个因素,即张瑞金被控的罪名严重、有潜逃风险,以及因调查仍在进行,被告有与他人串供和破坏证据的风险,拒绝让被告保释在外。

律师说,被告至今已被还押四个月,控方不应继续以调查仍在进行为由,反对被告获得保释。“控方无法确定调查何时结束,那岂不是能以这一理由还押被告两年?”

律师认为,法庭应把调查因素排除在外,单独考虑被告面对的罪行,以及被告的潜逃风险。

控方在庭上回应,距离被告上次申请保释才过了约一个月半,至今没有任何变数,而时间不能单独成为被告申请保释的因素,况且一个月半也并不长。

另外,被告在国外有数人协助他管理资产和生意,但却没有向当局提供相关人士的资料,因此若他保释在外,有与他人串谋或破坏证据的可能。

控方也以王水明向高庭申请推翻无保释庭令一案为例,法官已明确指出,保释申请一旦被驳回,除非情况有重大变数或出现新信息,否则对于持续向同一法院提出的保释申请,法院是极不愿意批准的。

法官发表决定时说,这是一起涉及多人的复杂案件,被告已被还押四个月不能构成重大变数,被告所面对的严重罪行,以及潜逃和串谋的风险仍然存在,最终驳回被告的保释申请。

Money laundering case: Accused Zhang Ruijin denied bail a second time

UPDATED 2023年12月11日 下午9:47 SGT

SINGAPORE – A judge has denied bail for Zhang Ruijin, one of the accused in a $2.8 billion money laundering case, saying the length of investigations is not so inordinately long as to prejudice Zhang.

He was arrested on Aug 15 and has been in custody since.

The hearing on Dec 11 was his second application for bail.

Zhang’s lawyer Eugene Thuraisingam told the court on Dec 11 that the prosecution cannot continue to rely on the argument that there is a risk of collusion while investigations are ongoing, to deny his client bail.

“My client has been remanded for four months and the prosecution is unable to state when investigations will end. My client cannot be remanded indefinitely,” he said.

Deputy Public Prosecutor Gan Ee Kiat said it has only been about 1½ months since Zhang’s previous bail review in October, and the “mere passage of time” does not constitute a material change in the accused’s circumstances to justify granting him bail.

He added that the investigation officer has scheduled three interviews with Zhang later in December, and plans to schedule more sessions with him in January 2024.

DPP Gan said: “This case is very complex; there are many moving parts with nine other accused persons and some people of interest overseas.

“We are doing all we can to expedite investigations, but the authorities will need more time. We cannot commit to a timeline at the moment.”

The DPP added that based on affidavits by the investigating officers, there is evidence to show Zhang is linked to other accused persons in the case and that there are several individuals overseas helping him manage his wealth.

“The accused has not identified (those overseas individuals) satisfactorily and the risk of collusion and contamination of evidence is very much at play,” he said.

The court previously heard that Zhang, a 44-year-old Chinese national, and another accused in the case, Lin Baoying, were lovers. The pair have known each other for more than a decade and their combined assets in Singapore come to about $325 million, according to affidavits by investigating officers on the case.

Lin, a 44-year-old Chinese national, has about $215.5 million in assets seized or frozen by the authorities. For Zhang, the amount in assets seized or frozen is at least $109.8 million.

Zhang faces three charges of forgery, while Lin faces two charges of forgery and one of perverting the course of justice.

They were arrested in a bungalow at Pearl Island in Sentosa Cove in August as part of police raids, which led to 10 people being charged in Singapore’s largest money laundering probe.

According to the affidavits, Lin has a 15-year-old daughter who lives in Beach Road with a domestic helper, while she lives with Zhang in Sentosa.

Zhang and Lin were denied bail on Oct 18 on the basis that they are flight risks, with multiple passports each.

In denying Zhang bail on Dec 11, District Judge Brenda Tan said that it remains that the accused faces serious charges and is a flight risk.

She said: “The law is clear in that once a bail application has been rejected, the court is extremely reluctant to grant bail unless the applicant is able to show new changes in circumstances or if new facts come to light.

“The defence argued that with the passage of time, the risk of the accused colluding with others and contaminating evidence should be given lesser weight.

“I am not satisfied that this constitutes a material change in circumstances and the accused should not be granted bail.”

S$2.8b money laundering case: Suspect denied bail a 3rd time after judge rules remand period not too long

- Zhang Ruijin returned to court to apply for bail on the grounds that the time he has spent in remand has been too long

- Zhang initially asked for bail when he was charged in August, but this was denied

- He applied for a bail review in October but this was refused on the basis of the serious charges against him, the risk of collusion with co-accused persons and that he is a flight risk

- In his latest application, the prosecution argued that the lapse of time alone cannot be a factor to justify the granting of bail

- The judge declined to grant bail, saying the investigation was not so inordinately long as to prejudice Zhang

SINGAPORE — Returning to court about six weeks after his last bail review, Zhang Ruijin, who is accused of playing a role in a S$2.8 billion money laundering case, has been denied bail for a third time.

The 45-year-old Chinese national faces three counts of forgery and was arrested on Aug 15 alongside co-accused and alleged lover Lin Baoying at a Sentosa Cove bungalow.

A total of 10 people stand accused of playing a role in the money laundering case.

On Monday (Dec 11), Zhang appeared in court through a video-link to again seek bail, this time on the grounds that his period in remand has dragged on for too long.

Zhang initially asked to be released on bail when he was arrested on Aug 16 but was denied.

He applied for a bail review on Oct 18, but this was rejected on the basis of the serious charges against him, the risk of collusion with co-accused persons and that he is a flight risk.

On Nov 20, Zhang attended a hearing to apply for bail but this was adjourned after the prosecution argued that the application was made without notice.

This time, Zhang’s lawyer Eugene Thuraisingam applied for bail on the grounds that the period in which Zhang had been held in remand amounts to a change in circumstances.

Mr Thuraisingam argued that at some point in time, it must become too long for an accused person to remain in remand pending investigation.

“It is a change in circumstances because there is a presumption of innocence and the prosecution cannot be allowed to indefinitely say that investigations are ongoing,” he said.

Mr Thuraisingam added that the court should now reconsider bail based on the seriousness of the charges Zhang faces and whether he is a flight risk.

He said that the court should give only limited weight to the prosecution’s argument that Zhang represents a risk of colluding with other accused persons and the pending investigations.

In response, Deputy Public Prosecutor (DPP) Gan Ee Kiat argued that lapse of time alone cannot be a factor and that 1.5 months since the last bail review was not so long as to justify the granting of bail.

He also disagreed with Mr Thuraisingam’s point about the risk of collusion having lost its weight, as the entire point in denying bail is that Zhang might tamper with evidence or collude with witnesses.

“It is an important consideration when it comes to his relationship with the other accused persons, of which there is evidence, and the fact that there are several individuals overseas who are helping him manage his wealth and businesses that have yet to be identified,” said DPP Gan.

After hearing from both sides, District Judge Brenda Tan declined to grant bail.

She said: “In my view, the fact that he has been in remand for about four months cannot be considered a material change in circumstances and it has only been 1.5 months since the last bail review.

“I say that the time has not come where the length of investigation in this case is so inordinately long that it is prejudicial to the accused.”

Zhang is set to return to court via video-link on Jan 12 for a pre-trial conference.

2023.12.7 警方在全岛执法行动中调查 373 名骗子和钱骡

商业事务科及七个警地分区人员于2023年11月24日至2023年12月7日期间进行了为期两周的行动。共有236名男性和137名女性,年龄介乎14岁至80岁,协助调查他们作为骗子或钱骡涉嫌参与的案件。据信,犯罪嫌疑人涉及超过1,200起诈骗案件,主要包括投资诈骗、电子商务诈骗、贷款诈骗、求职诈骗、冒充政府官员诈骗、网络爱情诈骗和冒充社交媒体诈骗,受害人蒙受损失超过千万。

嫌疑人因涉嫌欺诈、洗钱或无照提供支付服务等犯罪行为正在接受调查。根据 1871 刑法典第 420 条文,欺诈罪可判处最高 10 年监禁和罚款。根据 1992《腐败、毒品贩运和其他严重犯罪(没收福利)法》,洗钱罪可判处最高 10 年监禁、最高 50 万元罚款,或两者并罚。根据《2019 支付服务法》第 5 条,在新加坡未经许可开展提供任何类型支付服务业务的犯罪行为将被处以最高 125,000 元的罚款、最高三年的监禁,或两者并罚。

对于涉嫌诈骗的,警方将严肃查处,并依法严肃处理。为了避免成为犯罪共犯,公众应始终拒绝他人使用你的银行账户或手机线路的请求,因为如果这些与犯罪有关,你将被追究责任。

POLICE INVESTIGATE 373 SCAMMERS AND MONEY MULES IN ISLAND-WIDE ENFORCEMENT OPERATION

Officers from the Commercial Affairs Department and the seven Police Land Divisions conducted a two-week operation between 24 November 2023 and 7 December 2023. A total of 236 men and 137 women, aged between 14 and 80, are assisting in investigations for their suspected involvement in scams as scammers or money mules. The suspects are believed to be involved in more than 1,200 cases of scams, comprising mainly investment scams, e-commerce scams, loan scams, job scams, Government official impersonation scams, internet love scams and social media impersonation scams, where victims reportedly lost over 10 million.

The suspects are being investigated for the alleged offences of cheating, money laundering or providing payment services without a licence. The offence of cheating under Section 420 of the Penal Code 1871 carries an imprisonment term of up to 10 years and a fine. The offence of money laundering under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992 carries an imprisonment term of up to 10 years, a fine of up to $500,000, or both. The offence of carrying on a business to provide any type of payment service in Singapore without a licence under Section 5 of the Payment Services Act 2019 carries a fine of up to $125,000, an imprisonment term of up to three years, or both.

The Police take a serious stance against any person who may be involved in scams, and perpetrators will be dealt with in accordance with the law. To avoid being an accomplice to crimes, members of the public should always reject requests by others to use your bank account or mobile lines as you will be held accountable if these are linked to crimes.

For more information on scams, members of the public can visit www.scamalert.sg or call the Anti-Scam Helpline at 1800-722-6688. Anyone with information on such scams may call the Police Hotline at 1800-255-0000 or submit information online at www.police.gov.sg/iwitness. All information will be kept strictly confidential.

PUBLIC AFFAIRS DEPARTMENT

SINGAPORE POLICE FORCE

07 December 2023 @ 10:55 PM

2023.12.4“字述一年2023”投选活动

诈、战、难、智、热、丑、百、冲、洗、裂

哪个字最能代表2023年?

即日起至12月18日23:59前参与投选,就有机会赢取丰富奖品!

(抽奖仅限居住在新加坡的读者参与)

2023.11.24 316人涉逾1100起骗案助查 受害者损失超过850万元

涉在超过1100起骗案中充当骗子或钱骡,316名男女目前正协助新加坡警察部队调查,受害者被骗总金额超过850万元。

新加坡警察部队星期五(11月24日)发文告说,商业事务局和七大警署在11月10日至11月23日展开两周执法行动。协助调查的嫌疑人包括229名男子和87名女子,他们的年龄介于15岁至73岁,涉在骗案中充当骗子或钱骡。

警方透露,涉案男女涉嫌参与超过1100起骗案,主要包括求职诈骗、恶意软件诈骗、钓鱼诈骗,网络爱情诈骗和电子商务诈骗等。受害者在这些骗案中的损失相信超过850万元。

警方说,接受调查的嫌疑人被指诈欺、洗钱,或在没有许可证的情况下提供支付服务。根据《刑事法典》第420条规定,诈欺罪名若成立,可面对最长10年监禁和罚款,而根据《贪污、贩毒和严重罪案(没收利益)法令》,洗钱行为一旦被定罪,可被判最长10年的监禁、最高50万元的罚款,或两者兼施。

至于在没有许可证的情况下提供任何形式的支付服务,2019年1月出台的《支付服务法》第五条规定可处以最高12万5000元的罚款,或最长三年的监禁,或两者兼施。

警方强调,当局严厉看待涉嫌参与诈欺活动的任何人,违法者将依法处理。为了避免成为共犯,公众应拒绝他人要求使用个人银行账户或手机线路的要求,因为这些要求若与犯罪行为有关,涉事者将被追查。

POLICE INVESTIGATE 316 SCAMMERS AND MONEY MULES IN ISLAND-WIDE ENFORCEMENT OPERATION

Officers from the Commercial Affairs Department and the seven Police Land Divisions conducted a two-week operation between 10 November 2023 and 23 November 2023. A total of 229 men and 87 women, aged between 15 and 73, are assisting in investigations for their suspected involvement in scams as scammers or money mules. The suspects are believed to be involved in more than 1,100 cases of scams, comprising mainly job scams, malware-enabled scams, phishing scams, Government Officials Impersonation scams, Internet love scams, e-commerce scams, where victims reportedly lost over $8.5 million.

The suspects are being investigated for the alleged offences of cheating, money laundering or providing payment services without a licence. The offence of cheating under Section 420 of the Penal Code 1871 carries an imprisonment term of up to 10 years and a fine. The offence of money laundering under the Corruption, Drug Trafficking and Other Serious Crimes (Confiscation of Benefits) Act 1992 carries an imprisonment term of up to 10 years, a fine of up to $500,000, or both. The offence of carrying on a business to provide any type of payment service in Singapore without a licence under Section 5 of the Payment Services Act 2019 carries a fine of up to $125,000, an imprisonment term of up to three years, or both.

The Police take a serious stance against any person who may be involved in scams, and perpetrators will be dealt with in accordance with the law. To avoid being an accomplice to crimes, members of the public should always reject requests by others to use your bank account or mobile lines as you will be held accountable if these are linked to crimes.

For more information on scams, members of the public can visit www.scamalert.sg or call the Anti-Scam Helpline at 1800-722-6688. Anyone with information on such scams may call the Police Hotline at 1800-255-0000 or submit information online at www.police.gov.sg/iwitness. All information will be kept strictly confidential.

PUBLIC AFFAIRS DEPARTMENT

SINGAPORE POLICE FORCE

24 November 2023 @ 7:45 PM

2023.11.17 控方星期五在庭上指出,陈清远的案件涉及超过800万元,虽然陈清远在宣誓书声称这不是非法所得,包括其中第二项控状中的约624万元,是他每日埋头苦干为公司赚取的盈利,但他无法出示任何证据证明资金来源,而他所称的薪水也少过这笔款项的2%。

查案人员在宣誓书中揭露,陈清远被起获的资产共值约2145万5000元,警方也在他女友名下起获约424万元资产,当中包括现金、房产,以及轿车等。陈清远在海外拥有的资产也高达1322万元。

控方也指,陈清远在宣誓书中的说辞不诚实,其中包括指他并未被中国当局通缉。实则,陈清远曾向警方承认被中国当局通缉,因此不敢回中国。

控方指出,王宝森和妻女都是外籍人士,王宝森还持有中国和瓦努阿图的护照,在本地并无工作,2022年1月才移居新加坡。即使王宝森在宣誓书中指他的兄弟、侄女和母亲有意来新,但不能证明他们与新加坡有强烈联系。

另外,王宝森声称,他没有任何海外收入,但他曾在调查中承认,他在2019年至2023年期间从家族茶叶生意获得100万人民币(约19万1137新元)的利润。

调查显示,王宝森的家族仍在中国福建安溪经营茶叶生意,售卖铁观音,这笔生意仍可能为王宝森提供收入。王宝森的父亲也曾数次汇款30万至60万新元不等给他,他若潜逃,也有能力在国外过舒适生活。

28亿元洗钱案被告陈清远保释申请被拒

发布 /2023年11月17日 05:34 PM

涉28亿元洗钱案被告陈清远的案件过堂,陈清远称在本地有投资,且资产被冻结,因此不可能潜逃。控方反指他在至少六个国家进行投资,法官最终驳回被告的保释申请。

被告陈清远(33岁)上次过堂时,改聘德尊律师事务所刘家利律师为代表,控辨双方当时因为需要时间提交陈词,保释申请因此展期至星期五(11月17日)定夺。

控方星期五在庭上指出,陈清远的案件涉及超过800万元,虽然陈清远在宣誓书声称这不是非法所得,包括其中第二项控状中的约624万元,是他每日埋头苦干为公司赚取的盈利,但他无法出示任何证据证明资金来源,而他所称的薪水也少过这笔款项的2%。

查案人员在宣誓书中揭露,陈清远被起获的资产共值约2145万5000元,警方也在他女友名下起获约424万元资产,当中包括现金、房产,以及轿车等。陈清远在海外拥有的资产也高达1322万元。

控方也指,陈清远在宣誓书中的说辞不诚实,其中包括指他并未被中国当局通缉。实则,陈清远曾向警方承认被中国当局通缉,因此不敢回中国。

控方:陈清远在本地扎根不深 且有能力潜逃国外

另外,陈清远称已与家人在本地扎根,生意都在新加坡,实际上他在柬埔寨、泰国、马来西亚、菲律宾、中国也有投资,他在新加坡的“根”扎得不深,而且有能力潜逃到国外。

辩方律师刘家利在庭上指出,陈清远定居新加坡超过四年,他的家人则在本地生活至少六年,在新加坡经营生意,其中一家公司单在2022年就有1200万元的收入。陈清远的女友,以及两人生下的三名孩子都在本地,女友也在接受当局调查,并未带着孩子潜逃。

另外,陈清远的资产也已被冻结,没有能力再依靠投资获取新护照。洗钱案经过媒体报道,陈清远的名字已闻名国际,没有任何国家会批准他的护照申请。

法官:不曾踏足也能持多米尼克护照 说明他有能力取得他国护照

刘家利也说,陈清远愿意接受严苛的保释条件,除了佩戴电子追踪器和24小时被监督,甚至也愿意被软禁在家。

法官星期五发表决定时指出,陈清远持有中国、柬埔寨和多米尼克护照,其中多米尼克护照甚至是在他不曾踏足该国的情况下,通过投资和捐款取得的,这都说明他有能力以类似方式取得其他国家的护照。

法官认为,陈清远在本地扎根不深,且在海外持有可观资产,加上他面对的是严重罪行,有很高的潜逃风险,最终驳回陈清远的保释申请,并把案子展延至12月22日进行审前会议。

28亿洗钱案10名被告保释申请全被拒

随着陈清远的保释申请被驳回,涉及洗钱案的10名被告的保释申请已全部被拒,这意味着他们在案件审理期间将被继续还押,直至案件审结。

陈清远共面对四项贪污、贩毒、严重罪案(没收利益)法令的控状,指他持有59万8316新元和多种外币,全额或部分是欺骗罪赃款,以及持有花旗银行六个户头共逾624万元、轿车,以及加密货币,全额或部分来自非法线上赌博赃款。

涉28亿元洗钱案被告王宝森 保释申请再次驳回

发布 /2023年11月16日 06:55 PM

被指涉及28亿元洗钱案的被告之一王宝森再次申请保释,称妻儿都在新加坡且在海外没有任何收入。控方反驳他曾从家族生意取得可观利润,保释申请最后再被法官驳回。

王宝森(31岁)星期四(11月16日)通过律师再向法庭申请保释。他原本由Lighthouse Law律师事务所的黄恒毅律师代表,现改由Adelphi Law Chambers的江国文律师代表。

控方指出,王宝森和妻女都是外籍人士,王宝森还持有中国和瓦努阿图的护照,在本地并无工作,2022年1月才移居新加坡。即使王宝森在宣誓书中指他的兄弟、侄女和母亲有意来新,但不能证明他们与新加坡有强烈联系。

另外,王宝森声称,他没有任何海外收入,但他曾在调查中承认,他在2019年至2023年期间从家族茶叶生意获得100万人民币(约19万1137新元)的利润。

调查显示,王宝森的家族仍在中国福建安溪经营茶叶生意,售卖铁观音,这笔生意仍可能为王宝森提供收入。王宝森的父亲也曾数次汇款30万至60万新元不等给他,他若潜逃,也有能力在国外过舒适生活。

王宝森也在口供书中称,他申请土耳其护照是为了投资,但这与他告诉警方的信息不符。王宝森早前称,他申请土耳其护照是因为认为这会提高获得新加坡永久居民的概率,他在土耳其投资是为了获取护照。

警方在王宝森的住处并未起获土耳其护照,无法确认他是否也持有该护照。

涉嫌经营非法线上赌博 王宝森堂或表兄弟王斌刚目前在逃

另外,王宝森的堂兄弟或表兄弟王斌刚也涉嫌经营非法线上赌博生意,目前在逃。王宝森称自己对王斌刚涉及的赌博业务一无所知,不可能与他串谋。查案人员则指出,王宝森曾承认他参与非法线上赌博的工作,因此若他保释在外,有与他人串谋的风险。

代表律师江国文也在庭上说,王宝森的妻子何慧芳(译音)以及分别为三岁和四岁女儿都在新加坡,王宝森非常疼爱女儿,绝不会抛下妻儿潜逃。若王宝森有潜逃意图,就不可能让孩子在新加坡求学,还让其他家人来新。

江国文也说,若王宝森获准保释,可佩戴电子追踪器和每天向当局报到。新加坡到处都设有电眼,关卡和机场也有警方巡逻,王宝森不可能带着妻女潜逃。

法官说,自上次王宝森的保释申请被拒以来,情况没有发生变数或出现任何新信息。查案人员指出王宝森对不同方面说辞不一,也说明他不够坦白。

法官最终驳回王宝森的保释申请,案展12月22日进行审前会议。

王宝森面对两项抵触贪污、贩毒和严重罪案法案(没收利益)的控状,指他持有11万2000新元和几种外币,全额或部分是非法线上赌博赃款,以及持有丰田埃尔法混能引擎(Alphard Hybrid)汽车,购买款项全额或部分来自非法线上赌博赃款。

2023.11.15 被告苏宝林以患癌风险为由申请保释。理由是在监狱无法得到适当医疗照顾因而有患癌风险。

根据辩方陈词,被告患有严重心疾,患上胃癌的风险很高。樟宜医疗中心无法为被告提供足够和适当的照顾,且没有被告需要的药物,继续还押被告就如同“在以被告的生命做不必要的赌博”。

控方:辨方说法是对新加坡监狱署严重指控,控方需要时间向监狱署和警方查询,且得准备至少一份来自监狱署的宣誓书,以及对辩方的陈词作出回应。

法官发表决定时说,辩方在星期三早上才提交陈词,且当中有控方从未见过的两份医疗报告,因此,控方的展期申请合理。法官最终裁定,将保释申请展期至12月15日。

28亿洗钱案 被告苏宝林以患癌风险为由申请保释

发布 /2023年11月15日 09:34 PM

涉及28亿元洗钱案的10名被告自面控以来一直还押至今,被告之一苏宝林星期三再次申请保释,理由是在监狱无法得到适当医疗照顾因而有患癌风险。对此,控方表示需要时间回应,法官决定展期至下个月15日再做定夺。

被告苏宝林(41岁)星期三(11月15日)再度通过柯吴律师事务所刑事部门主管苏呢尔(Sunil Sudheesan),向法庭申请保释。

控方在案件过堂时请求法官,展期对此项保释申请做出定夺。控方指辩方星期三早上才提交相关陈词,控方需要时间准备,以提交宣誓书,以及对陈词作出回应。

根据辩方陈词,被告患有严重心疾,患上胃癌的风险很高。樟宜医疗中心无法为被告提供足够和适当的照顾,且没有被告需要的药物,继续还押被告就如同“在以被告的生命做不必要的赌博”。

另外,被告住家距离最近医院比监狱与最近医院的距离来得短。苏呢尔也在庭上说,癌症应该尽早检查,越快接受治疗越好。

控方:辨方说法是对新加坡监狱署严重指控

控方指出,辨方的说法是对新加坡监狱署的严重指控,控方需要时间向监狱署和警方查询,且得准备至少一份来自监狱署的宣誓书,以及对辩方的陈词作出回应。

辩方也在庭上提到,可给被告设下严格的保释条件,如接受24小时的监视等。辩方认为,这些条件足以管控被告潜逃和与他人串谋的风险。若被告触犯任何保释条件,保释也可随时撤销。

保释申请展期至12月15日

法官发表决定时说,辩方在星期三早上才提交陈词,且当中有控方从未见过的两份医疗报告,因此,控方的展期申请合理。法官最终裁定,将保释申请展期至12月15日。

苏宝林共面对两项控状,指他给花旗银行提交伪造的“收入申报证明”文件,以及与一名叫王启明的男子串谋伪造一份“借贷合约”,意图欺骗渣打银行。

案件9月6日过堂时,法官批准控方针对苏宝林的还押候审申请。法官当时指出,持有两个不同国家护照的苏宝林在中国拥有公寓,具备移居外地的能力,即使家人在新加坡,也不意味着他不会弃保潜逃。

患癌几率高也要照顾自闭儿 苏宝林“卖惨”要求保释再被拒

发布 15/11/2023 16:16

涉及本地最大起洗钱案的被告之一苏宝林,通过代表律师表示,医生诊断自己患上胃癌的几率高,第二个孩子患有自闭症,他希望可以保释外出接受更好的医疗照顾和照顾儿子,要求保释再被拒。

柬埔寨籍41岁的苏宝林今天(15日)再次在国家法院提出保释申请,他的代表律师苏呢尔提呈了一份保释申请陈词,揭露苏宝林不是一般的病患,而是随时都有生命危险的病患。

他除了患有先天性心脏疾病外,他在一般室温的血氧水平只在85%到88%之间徘徊,而一个健康成年人的正常血氧水平应该是至少95%。律师说,苏宝林在被捕前通常都可随身准备了氧气筒供他吸氧。

苏宝林目前面对两项控状,都指他伪造文件。苏宝林自从被捕后,一直以身患先天性心脏疾病需要医疗服务,家人都在新加坡以及其中一个孩子是特需孩童,他不会潜逃为由申请保释,但每次都被法官驳回。

患胃癌风险高 樟宜监狱缺乏相关医疗设施

根据律师,苏宝林今年7月份接受健康检查时,医生诊断出他患上胃癌的风险高,建议他要按时看医生观察,但他在体检约一个月后就被捕被还押至今,所以他到现在还无法就胃癌风险一事继续求医。

律师说,苏宝林在樟宜机监狱还押期间,一度因血压骤降而被紧急送去樟宜综合医院求医。律师说这也充分显示樟宜监狱并没有完善的医疗设施可及时为苏宝林提供医疗所需。

另外,律师也说苏宝林在狱中时曾在今年10月10日突然头部剧烈疼痛,血氧水平之后下降到84%左右,但遗憾的是监狱署并没有及时给苏宝林提供氧气服务,这有违法庭的指示。

此外,律师还透露苏宝林因为心脏问题,无法适应中国的四季气候,尤其是寒冷的冬天。相反的,本地的热带天气非常适合他养病,加上这里的医疗发达,为了自身的健康,他更加不会离开。

孩子有自闭症 希望在本地获更好学习机会

律师说,苏宝林带着一家老小于2017年迁居本地,四个年幼的孩子目前都在本地求学,其中第二个孩子患有自闭症,是个特需孩童。

苏宝林本着希望他可获得更好的照顾和学习的机会,才带着孩子迁居本地,因此没有理由会丢下全家人自己潜逃出去。

愿意遵守任何保释条件 不靠近任何关卡港口

律师说,苏宝林愿意遵守任何严格的保释条款,包括24小时监视、佩戴电子追踪器,不会靠近新加坡各大港口或关卡的一公里范围内,以及每天向调查官报到甚至愿意让当局派专人监视。一旦他试图和他人串通,可及时通报给当局等等。

主控官反驳辩方的保释申请,表示辩方今早才将苏宝林的相关医药报告交给控方,让控方根本没时间作出回应,因此要求法官将案件展期。

法官最终同意需要给控方时间,苏宝林暂时不得保释,案展12月15日再度过堂。

2023.11.15 警方11月15日前往苏宝林位于那森路的住所搜证,并拖走六辆豪车。

记者接获消息,于星期三早上10时30分赶往苏宝林位于那森路(Nassim Road)的优质洋房住所时,发现里面至少有三名调查人员在场。据了解,调查人员来自商业事务局。

在上午约11时30分,三辆拖车抵达豪宅,将一辆法拉利和两辆丰田埃尔法(Toyota Alphard)多用途车拖走。

大约一小时后,三辆拖车折返,再拖走一辆宾利、一辆劳斯莱斯及一辆丰田埃尔法。

期间,现场一度发生小插曲,拖拉宾利的车架出状况,轮子突然脱落,工作人员花了数分钟安装新轮,最终才顺利将车拖走。

据观察,这些被拖走的汽车都布满灰尘,另外,洋房前还堆放了一些桌椅和漆桶,屋内只有一名女郎出入,但面对媒体询问时不愿发言。此外,屋内还有一名油漆工。

返苏宝林洋房调查 警拖走六豪车

新明日报 更新: 2023-11-15 02:59 PM

28亿元洗钱案新进展!记者现场直击,警方星期三(11月15日)早上重返涉案被告苏宝林的豪华洋房调查,现场逗留逾三小时,先后拖走六辆豪车。

我国警方8月捣毁本地最大宗的洗黑钱案,涉案金额超过28亿元,共九男一女被控,苏宝林(41岁)是其中一人。

《新明日报》记者接获消息,于星期三早上10时30分赶往苏宝林位于那森路(Nassim Road)的优质洋房住所时,发现里面至少有三名调查人员在场。据了解,调查人员来自商业事务局。

在上午约11时30分,三辆拖车抵达豪宅,将一辆法拉利和两辆丰田埃尔法(Toyota Alphard)多用途车拖走。

大约一小时后,三辆拖车折返,再拖走一辆宾利、一辆劳斯莱斯及一辆丰田埃尔法。

期间,现场一度发生小插曲,拖拉宾利的车架出状况,轮子突然脱落,工作人员花了数分钟安装新轮,最终才顺利将车拖走。

据观察,这些被拖走的汽车都布满灰尘,另外,洋房前还堆放了一些桌椅和漆桶,屋内只有一名女郎出入,但面对媒体询问时不愿发言。此外,屋内还有一名油漆工。

一名不愿具名的邻居透露,自从洗钱案曝光后,就再也没有看到该住所内有任何人进出。

完整报道,请翻阅2023年11月15日的《新明日报》。

2023.11.7 涉假冒公务员骗走逾9万元 18人被捕21人助查

犯罪团伙精心布局,找来不同人分饰五个角色,让受害者误以为自己牵扯进洗钱案,再借机骗走超过9万元。警方接到报案后展开搜捕行动,逮捕18人之余,还有21人正在协助调查,当中年龄最小者只有16岁。

新加坡警察部队星期二(11月7日)发文告说,警方在10月21日接到通报,一名男子坠入假冒公务员骗局,损失9万余元。

调查显示,受害者在10月20日接到一名女子来电,对方声称来自星展银行,发现有三笔款项要从受害者的星展银行户头转到一个大华银行户头,因此拨电向受害者查证。

当受害者指自己没有进行上述转账后,对方便说案件要转到金融管理局处理。

不久后,一名声称来自警队的男子拨电给受害者,还通过WhatsApp发来一张假警察证。受害者放下戒心后,对方便指受害者涉及一起洗钱案,有一笔8万元的赃款转入受害者户头。对方还谎称当局从一名落网的嫌犯身上搜出受害者的信用卡,要受害者配合调查。

团伙后来化身三个假警接连拨电给受害者,过程中也通过WhatsApp发了两封有警队标志的信函,指示受害者开设一个华侨银行的“安全户头”,声称只要把钱转入这个户头,当局就可以追查款项的动向。受害者不疑有诈,落入圈套后转了9万多元。

受害者事后察觉被骗,于是报警处理。反诈骗指挥处和商业事务局随即进行调查,并在10月21日至11月6日,展开全岛执法行动逮捕18人,他们年龄介于17岁至41岁。

另有21人也因此案正在协助警方调查,他们的年龄介于16岁至55岁。

18名被捕者中,有五人已于星期二被控,另一人会在星期三(8日)被控。

被捕者疑在这起诈骗案中扮演不同角色,有些涉嫌转售自己或他人的银行户头和资料,有些则帮忙提取现金和转交现金,一人则协助购得银行户头和开设网上银行户头。

警方从其中三人身上搜出五台手机、超过94张电话卡,以及至少83张银行卡等。

案件还在调查中。

18 PERSONS ARRESTED AND 21 PERSONS UNDER INVESTIGATION FOR SUSPECTED INVOLVEMENT IN GOVERNMENT OFFICIALS IMPERSONATION SCAM CASE

A total of 18 persons, aged between 17 and 41, have been arrested; and another 21 persons, aged between 16 and 55, are being investigated for their suspected involvement in a Government Officials Impersonation Scam (“GOIS”) case, following an island-wide anti-scam enforcement operation conducted between 21 October 2023 and 6 November 2023.

On 21 October 2023, the Police received a report that a victim had fallen prey to a GOIS, incurring more than $90,000 in losses. Through investigations, the money was found to have been layered through a complex network of bank accounts. Eventually, all of the victim’s losses were withdrawn from Automated Teller Machines (ATMs) within the same day.

On 20 October 2023, the male victim had received a call from a female caller (scammer) claiming to be acting for “DBS”, who alleged that someone had attempted to make three bank transactions to transfer funds from the victim’s DBS bank account to a UOB bank account. The woman claimed that she was calling to verify the transfers with the victim. When the victim confirmed that he had not authorised any such transfers, he was told by the scammer that the matter will be referred to the Monetary Authority of Singapore (MAS) under the “MAS Regulations”.

Shortly after, the victim received a call from a male caller claiming to be “Inspector Hoo Jun Hoon” (scammer) from the “Singapore Police Force”. “Inspector Hoo” then sent the victim an image of a fake Police warrant card via WhatsApp. The caller alleged that the victim was a suspect in a case of money-laundering where $80,000 was transferred to his bank account, and the victim’s credit card was found in the possession of a “suspect” whom the “Police” had “arrested”. When the victim denied being involved, he was told to render his cooperation.

Subsequently, the victim received a call from “Inspector Gavin Wei Jun” (scammer), claiming to be “Inspector Hoo’s” superior from the “Commercial Affairs Department”. The victim was told that a formal investigation would be opened and that his full cooperation was required to clear him of money-laundering charges. He was told that “Inspector Gavin” was his liaison officer, and that “Senior Inspector Wong Siew Chong” (scammer) was the overall in charge of the case.

When “Senior Inspector Wong” called the victim, he was referred to an audit officer “Investigation Officer Chua Chee Hong” (scammer) who had to conduct financial inspection of the victim’s personal DBS account. “Investigation Officer Chua” then sent the victim two letters with the Singapore Police Force’s logo via WhatsApp and instructed the victim to open an “OCBC safety account” as this was required by the investigation. The victim was then told to transfer a specific sum of money to this “safety account” so that the investigator could track the movement of the money. Believing that this safety account belonged to him, the victim complied and transferred more than $90,000 to this “safety account”.

Following the victim’s lodging of a police report, officers from the Anti-Scam Command of the Commercial Affairs Department commenced investigations, which led to the conduct of an island-wide operation. 12 individuals were arrested for suspected involvement in selling and renting their bank accounts by relinquishing their bank cards and iBanking credentials to criminal syndicates. A further 21 individuals are assisting with investigations.

Five of those arrested have been charged, and a sixth person will be charged tomorrow, for offences under the Computer Misuse Act 1993 for abetting persons to secure unauthorised access to our banks’ computer systems:

- a 32-year-old male for selling his bank account to a criminal syndicate.

- a 29-year-old male for facilitating the sale of another person’s bank account to the criminal syndicate.

- a 31-year-old male and a 19-year-old male for assisting the syndicate to perform cash withdrawals from fraudulently obtained bank accounts. At least five mobile phones, more than 90 SIM cards and about 80 bank cards were seized from them.

- a 32-year-old male for collecting cash withdrawn by the 31-year-old male which he subsequently handed over to another member of the syndicate.

- a 24-year-old male for assisting the criminal syndicate to activate fraudulently obtained bank cards and registering the corresponding iBanking accounts. At least three bank cards, four SIM cards and numerous bank correspondences were seized from him.

For abetting persons to secure unauthorised access to the bank’s computer system, the offence under Section 3(1) read with Section 12 of the Computer Misuse Act 1993 carries a fine of up to $5,000, an imprisonment term of up to two years, or both, for a first-time offender.

The Police take a serious view of the offence and will not hesitate to take action against individuals who may be involved in scams and money laundering. Perpetrators will be dealt with in accordance with the law.

To avoid being an accomplice to these crimes, members of the public should always reject requests by others for their personal bank accounts to be used to receive and transfer money for others. The Police would like to remind members of the public that individuals will be held accountable if they are found to be linked to such crimes.

Members of the public are advised to adopt these three measures to A-C-T (Add, Check, Tell) against scams:

PUBLIC AFFAIRS DEPARTMENT

SINGAPORE POLICE FORCE

07 November 2023 @ 9:50 PM

2023.11.2 28亿洗钱案被告苏文强潜逃风险高 保释申请被拒

28亿洗钱案被告苏文强潜逃风险高 保释申请被拒

发布: 2023-11-02 11:05 PM

涉28亿洗钱案被告苏文强的案件过堂,因苏文强有能力获取他国护照并且在国外拥有资产,还可能有人协助他潜逃,法官批准控方将他还押候审的申请,案展12月进入审前会议。

被告苏文强(31岁)面对两项抵触贪污、贩毒、严重罪案(没收利益)法令的控状,指他持有60万1706元,全额或部分是非法线上赌博赃款,并使用从菲律宾非法线上赌博获得的50万元,购买马赛地AMG C63S汽车。

取得护照前从未去过柬埔寨和瓦努阿图

法官发表决定时说,苏文强面对的是不可保释的控状,他不是新加坡公民或永久居民,国籍是柬埔寨。苏文强还持有中国、柬埔寨和瓦努阿图三个国家的护照。尽管在取得护照前从未去过柬埔寨和瓦努阿图,他仍有能力取得护照。

另外,苏文强在2021年移居新加坡,虽然他的两个孩子在本地国际学校求学,但妻儿同样不是新加坡公民或永久居民,父母则仍在中国居住,显然在新加坡扎根不深。

法官说,被中国当局通缉的苏文强,现在面对的是严重罪行,他有再度潜逃的动机。他在中国拥有价值190万新元的房产,而且也有可能会协助他潜逃的同伙。

因此,法官认为苏文强潜逃的高风险确实存在,最终批准控方的无保释申请,让苏文强还押候审。

案件星期四(11月2日)过堂时,苏文强穿着白衣,戴着眼镜通过视讯出庭,神色冷静。他的代表律师是Gabriel Law Corporation的玛诺之(Manoj Nandwani)和萨米尔(Sameer Melber)。

辩方:所涉菲律宾赌博活动在菲是合法生意 获当局批准

辩方律师在庭上指出,控状指苏文强涉及菲律宾的非法赌博活动,但这在菲律宾是合法的生意,并得到菲律宾当局的批准。

另外,苏文强带着妻子和年龄分别为五岁和六岁的孩子,让孩子在这里接受教育,早有在新加坡定居的计划。

律师也说,苏文强愿意遵守严格的保释条件,如佩戴电子追踪器等,这些条件已足够应对控方所说的潜逃风险,因此请求法官让他保释在外。

控方却指出,苏文强面对的是不得保释的控状,且他持有中国、柬埔寨和瓦努阿图的护照,即使他的护照已被收缴,但仍说明他有能力获得他国的护照。

调查官宣誓书:赌博生意主要客源来自中国 被告以现金领薪水

调查官的宣誓书揭露,苏文强是菲律宾和柬埔寨的远程赌博生意的高管,这门生意以中国赌客为主。而且,苏文强是以现金领取薪水,当局也有证据证明控状中款项与上述生意相关。

另外,苏文强自2017年因非法赌博活动被中国当局通缉,他通过远程赌博生意的同伙安排取得瓦努阿图的护照,并使用这本护照出国。

调查显示,苏文强与目前被新加坡警方通缉的四人有联系,他们曾通过通信平台讨论赌博网站的运营和资金转移。若苏文强保释在外,他们有可能助他潜逃。

控方也说,虽然苏文强称赌博生意合法,却没有出示任何许可证明文件。

控方在庭上透露,目前针对苏文强的调查仍在进行中,日后有加控的可能,因此申请将案件延展六周。

案件展期至12月14日进行审前会议。

法官早前也批准控方对其他八名被告林宝英(43岁)、王德海(34岁)、张瑞金(44岁)、苏剑锋(35岁)、王宝森(31岁)、王水明(42岁)、苏海金(40岁)和苏宝林(41岁)的还押候审申请。陈清远(33岁)的无保释申请则展期决定。

Billion-dollar money-laundering case: Wanted man accused of laundering S$500k by buying car denied bail

Su Wenqiang was purportedly recruited to be an executive in a remote lottery business based in the Philippines and Cambodia and was paid for his work in cash.

02 Nov 2023 06:39PM

(Updated: 03 Nov 2023 07:49AM)

SINGAPORE: Yet another accused person in the billion-dollar money laundering probe has been denied bail, with the investigating officer alleging that Su Wenqiang was wanted in China and worked in a remote lottery business operating from the Philippines and Cambodia.

Su, a 31-year-old man listed as a Cambodian national in charge sheets, is accused of two offences: Having S$601,706 (US$441,000) that comes at least in part from illegal remote gambling offences, and using S$500,000 in illegal proceeds to buy a Mercedes Benz AMG C63S in January last year.

Su has passports from China, Cambodia and Vanuatu and is shown in his Chinese passport to be from Fujian.

His lawyers, Mr Sameer Amir Melber and Mr Manoj Nandwani from Gabriel Law Corporation, applied for him to be released on bail on Thursday (Nov 2).

Mr Sameer said there has been extensive media attention surrounding this case, but the prosecution has tried to group all 10 accused people together and link them.

He argued that his client was not a flight risk. Most of his assets have been seized, and even if he has a house in China, he is wanted there.

Mr Sameer said it was unlikely that further evidence would be obtained through remanding his client further, and said there has been no charge for common intention or conspiracy involving his client.

While the prosecution had said there were four individuals who could help Su escape, Mr Sameer said that by the prosecution’s own submissions, the four people were simply not in Singapore at the time of the police raid.

It was not as if they had escaped, he said.

He said his client was a father of two young children aged five and six and that he had moved them to Singapore intending to live here permanently and to benefit from the “robust education system”.

Deputy Public Prosecutor Edwin Soh pointed to the affidavits filed by the investigating officer on Su’s case in objecting to bail.

According to Senior Investigation Officer with the Criminal Investigation Department Mr Francis Lim, Su was arrested on Aug 15 after the islandwide raid conducted by the Singapore Police Force linked to money-laundering offences.

A total of S$601,706 in cash linked to Su has been seized, along with his wife’s bank account containing about S$2 million and two vehicles worth at least S$584,000 in his wife’s name.

The second charge for the Mercedes Benz was tendered after investigations found that Su had bought it with S$500,000 in cash, Mr Lim said.

In total, Su faces offences involving suspected criminal proceeds of over S$1.1 million, which Mr Lim said was “no small sum”.

He said further charges may be tendered against Su as investigations are still at an early stage and the police are still examining the sources of Su’s wealth.

THE IO’S INVESTIGATIONS SO FAR

Mr Lim said investigations so far show that Su was recruited to be an executive in a remote lottery business operating from the Philippines and Cambodia.

The business targeted gamblers from China, and investigations show that he was paid for his work in cash. There is also evidence that the money in Su’s charges can be linked to these illegal remote gambling operations overseas, Mr Lim said.

He said it would be “a great injustice” if Su managed to abscond and evade the charges.

He said Su has been wanted by Chinese authorities for his illegal gambling activities since 2017, and knows this.

He admitted that an associate in the remote lottery business arranged for him to procure a passport from Vanuatu through a courier, and he used this passport to travel, said Mr Lim.

He said Su has no strong roots in Singapore. His parents live in China while his wife and children are Chinese nationals.

He has a house in Xiamen worth around S$1.9 million under his wife’s name, and accomplices who may help him abscond, said Mr Lim.

“Based on the mobile phones seized from the accused, he and his accomplices would communicate with each other in WhatsApp and Telegram group chats to discuss the operations of their remote gambling websites,” said Mr Lim. “They would also discuss the transnational movement of funds from the remote gambling websites.”

He said these accomplices are at large and can help Su abscond.

The judge dismissed the bail application, saying Su has only been in Singapore for two years after moving here with his family in 2021 and is neither a citizen nor a permanent resident. She fixed the case for a pre-trial conference in December.

Money laundering accused on the run from Chinese authorities, came to S’pore in 2021: Prosecutor

SINGAPORE – One of the 10 people accused in Singapore’s largest money laundering case was not just a foreigner when he came to Singapore in 2021.

He was a fugitive on the run from the Chinese authorities, said the prosecution on Thursday.

This was revealed at the bail review for Cambodian national Su Wenqiang, 31. His application for bail was denied.

In arguing for his client to be released on bail, Su’s lawyer Sameer Amir Melber said Su came to Singapore in 2021 with his wife and children, aged five and six, as he wanted his children to be educated here.

But Deputy Public Prosecutor Edwin Soh said: “The fact that his children study in Singapore is clearly insufficient to show that he is not a flight risk.

“The accused is not just a foreigner who came to Singapore in 2021. He is also a wanted fugitive who is currently evading Chinese authorities. He is currently on the run (from the authorities in China).”

Senior investigation officer (SIO) Francis Lim of the Criminal Investigation Department said in an affidavit that Su has been wanted by the Chinese authorities for illegal online gambling activities since 2017.

SIO Lim said Su was recruited to be an executive at a remote lottery business operating from the Philippines and Cambodia, and targeting gamblers from China. He was paid in cash.

Su and his accomplices would communicate via WhatsApp and Telegram group chats to discuss their operations, including moving funds from remote gambling websites across borders, said SIO Lim.

He said these four accomplices are wanted by police here, as they were not in Singapore when anti-money laundering raids were conducted here on Aug 15.

In Su’s affidavit, he claimed even if he were to be granted bail, he would not be able to contact his accomplices as his laptops and mobile phones had been seized.

But SIO Lim argued that Su could use another device to access his WhatsApp and Telegram accounts and get his accomplices’ help to abscond.

Su, who was arrested at a good class bungalow in Bukit Timah on Aug 15, faces two money laundering charges. He was charged on Aug 16 with allegedly possessing $601,706, which is said to represent his benefits from criminal conduct.

He was handed another charge on Aug 30 for allegedly buying a Mercedes-Benz AMG C63S car using $500,000 that was allegedly his benefit from providing an unlawful remote gambling service based in the Philippines for people in China.

SIO Lim noted in his first affidavit that the police also seized two vehicles in Su’s wife’s name, with an estimated value of at least $584,000, and more than $2 million parked in her bank account.

Su also has substantial wealth overseas, including a house in Xiamen worth around $1.9 million and registered to his wife Su Yanping.

On Thursday, Mr Sameer told the court that his client had said all gambling services in the Philippines were approved by the authorities there. He added that the remote gambling services were not facilitated in Singapore and no one here had used these services.

But DPP Soh said in his submissions that Su had not shown any licence for the remote gambling business to the police.

And even if the business was legal in the Philippines, Su had purportedly provided gambling services to Chinese citizens in China, which is an offence in China, said DPP Soh.

Su appeared via video link in a white shirt and kept his head down during proceedings.

At the hearing on Aug 30, he had said in Mandarin that he was on the verge of a mental breakdown and requested that the court grant him bail.

In denying Su bail on Thursday, District Judge Brenda Tan noted that he was neither a Singapore citizen nor a permanent resident here.

She said: “He owns passports from Cambodia, China and Vanuatu. He did not dispute that he was able to obtain his passports from Cambodia and Vanuatu with ease even though he had never been to those countries.”

She added that Su’s parents reside in China and his family members are foreigners, thus clearly showing he has no deep roots in Singapore.

The judge said: “Moreover, he is a fugitive who has been on the run. Mr Su would thus have the motive and incentive to relocate and flee again.”

She noted that he has accomplices at large who may assist him in absconding.

Ten foreigners, all originally from China, were charged on Aug 16 with various offences, including money laundering, forgery and resisting arrest.

The authorities have since taken control of more than $2.8 billion worth of assets, including 152 properties and 62 vehicles with an estimated value of more than $1.24 billion.

The assets also include money in bank accounts amounting to more than $1.45 billion, and cash in various currencies worth more than $76 million.

Thousands of bottles of liquor and wine, cryptocurrency worth more than $38 million, 68 gold bars, 294 luxury bags, 164 branded watches and 546 pieces of jewellery were also seized.

It is Singapore’s biggest money laundering case and said to be one of the world’s largest.

Su’s case is scheduled for a pre-trial conference on Dec 14.

2023.10.31 警方在7月27日至9月14日期间接到多起报案,称有人利用恶意软件入侵安卓移动设备,在受害者没有向任何人泄露网上银行资料、一次性密码(OTP)或Singpass资料的情况下,银行账户还是出现未经授权的交易。

在这些案件中,受害者都曾在脸书等社交媒体平台上回应一些广告,内容包括清洁服务、售卖月饼、海鲜等食品和杂货等。他们随后被不法之徒指示,从非官方平台下载安卓应用软件安装包,导致手机被安装恶意软件。

经过后续调查,商业事务局的查案人员逮捕了九名年龄介于16岁至30岁的涉案男女。

疑助不法之徒洗钱 九人被控 年纪最小者仅16岁

发布 2023.10.31

疑为赚快钱出让银行户头和Singpass资料, 方便不法之徒进行诈骗,包括三名青少年在内的九人星期二(10月31日)被控。

新加坡警察部队星期一(30日)晚发文告说,警方在7月27日至9月14日期间接到多起报案,称有人利用恶意软件入侵安卓移动设备,在受害者没有向任何人泄露网上银行资料、一次性密码(OTP)或Singpass资料的情况下,银行账户还是出现未经授权的交易。

在这些案件中,受害者都曾在脸书等社交媒体平台上回应一些广告,内容包括清洁服务、售卖月饼、海鲜等食品和杂货等。他们随后被不法之徒指示,从非官方平台下载安卓应用软件安装包,导致手机被安装恶意软件。

经过后续调查,商业事务局的查案人员逮捕了九名年龄介于16岁至30岁的涉案男女。

这九人都涉嫌将自己的个人或银行资料,或者Singpass户头售卖给不法之徒,从中赚取快钱,也方便不法之徒用来进行诈骗。其中三人将Singpass资料交给不法分子,其他六人将银行户头转让给他人或开新的户口,让不法之徒使用。

泄露Singpass登录资料的初犯者若罪立,将面对最高1万元的罚款,最长三年的监禁,或两者兼施。转让个人银行户头的初犯者若罪立,将面对最高5000元罚款,最长两年监禁,或两者兼施。

根据刑事法典第417节条文,欺骗罪名若成立,可面对最长三年监禁,或罚款,或两者兼施;未经授权获取电脑资料一旦罪成,初犯者可面对最长两年监禁,或罚款,或两者兼施;未经许可披露访问代码一旦罪成,初犯者可面对最长三年监禁,或罚款,或两者兼施。

警方强调将依法严惩任何可能参与诈骗的嫌犯。

2023.10.25 涉及金额28亿元的本地最大宗洗钱案有新进展,警方到其中一名被告住所,拖走四辆名车。

8 月 15 日,新加坡接线报,出动超过 400 名来自商业事务局、刑事侦查局、警察部队的特别行动指挥处(Special Operations Command)和警察情报局的查案人员,在全国多个地方展开稽查行动,并于武吉知马、乌节路等超豪华别墅和公寓区逮捕 10 人。

同时,警方对价值约 8.15 亿新元的 94 处房产、50 辆汽车和一批名酒发出了禁止处置令,并查获了超过 1.1 亿新元存款的 35 个相关银行账户和 2300 万新元现金,以及 250 个奢侈品包和手表、270 多件珠宝首饰等奢侈品和 11 份虚拟资产信息文件。

随着调查的深入,警方捕获的总金额持续增加,94 处房产增加到 110 处,50 辆汽车增加至 62 辆,确定的涉案人数也从原来的 10 人增加到 34 人,已被扣押在银行户头的资金超过 55 亿,现金超过 3.8 亿,仅金条总数就有 68 根,虚拟资产金额达到 1.9 亿元。

被捕获的 10 名犯罪分子分别为苏海金(40岁)、苏宝林(41岁)、苏剑锋(35岁)、张瑞金(44岁)、林宝英(43岁)、王水明(42岁)、陈清远(33岁)、苏文强(31岁)、王宝森(31岁),以及王德海(34岁)。其中,张瑞金和林宝英为同居情侣关系。10 人原籍均为中国福建闽南地区,被知情人士称为福建帮,该帮派主要以姓氏宗族划分,苏姓、王姓、胡姓和陈姓是该帮派中的主要分支。

从国籍护照来看,仅有张瑞金、林宝英、王宝森为中国籍,其他均以其他国籍入境新加坡,其中陈清远、苏文强、苏宝林为柬埔寨籍;苏海金、王德海为塞浦路斯籍、王水明为土耳其籍、苏剑锋则是瓦努阿图籍。

目前,除了上述10人被控,相信还有24人是他们的关系人。根据新加坡警察部队之前的文告,有12人正在协助调查,八人被通缉。

涉洗钱案被告苏剑锋 四豪华车被警拖走

发布 /2023年10月25日 11:25 PM

涉及金额28亿元的本地最大宗洗钱案有新进展,警方到其中一名被告住所,拖走四辆名车。

10名涉案被告之一的苏剑锋(35岁),面对四项控状抵触贪污、贩毒和严重罪案(没收利益)法令的控状。

苏剑锋早前在武吉知马3道租住的优质洋房内被捕,警方星期三(10月25日)下午2时30分再次上门,用拖车将他名下的四辆豪华车子拖走。

据观察,四辆车子分别是深红色劳斯莱斯曜影、黑色劳斯莱斯库里南豪华房车、橙色保时捷跑车和白色丰田埃尔法多用途休旅车。

根据苏剑锋9月的宣誓书显示,四辆车子总值474万5000元。

现场约有八名警员,他们为四辆车子逐一详细检查后拍照记录,约40分钟后用拖车逐辆拖走。

据了解,苏剑锋的妻子当时也在屋里,但没有露面也拒绝应门。邻家一名不愿透露名字的司机说,星期一(23日)曾看到屋子的阳台亮着灯。

他也说,苏剑锋夫妇似乎和两名中学年纪的孩子、两名缅甸籍女佣和一名司机同住,平时最常开的是白色的丰田多用途休旅车。

“那两个看似就读中二中三的孩子,有时会在外面打篮球。”

据一名邻居家的司机说,最常看到苏家的司机开这辆白色豪华丰田埃尔法多用途休旅车。

另一名邻居则说,苏剑锋一家人很低调,邻居鲜少看见他们,也很少打招呼,甚至没有留意到这户家人是什么时候搬来的。

另外,警方当天也在另一地点起获56个潮牌玩具Bearbrick积木熊。

警方早前从28亿洗钱案中起获的物件,也有大约60个潮牌玩具藏品Bearbrick积木熊,本地资深玩家和潮玩卖家估计,那60个积木熊价值大约在80万至100万元。Bearbrick积木熊属于潮玩,有艺术品的收藏属性,也具有投资价值。

苏剑锋是瓦努阿图籍,也持有中国护照。他和妻子名下的涉案资产总值已超过2亿3110万元,其中包括刚被拖走的四辆总值474万5000元的名车、超过1亿1534万元的13套房产、6613万7000元银行存款、2646万1000元的加密货币,以及1841万8000元的现金。

法院随后将根据既定调查结果,就如何处理本案所涉资产发出指令。

苏剑锋目前面对四项抵触贪污、贩毒和严重罪案(没收利益)法令的控状。

28亿元洗钱案后续六大答问

发布 /2023年10月03日 11:27 PM

- 当局什么时候开始调查洗钱案?

2021年,当局侦测到可疑活动,包括有人提交疑似伪造文件给银行,金融机构和公司也提交可疑交易报告。2022年初,警方发现有一群人涉案,当中相信有亲属关系。2023年初,警方掌握足够证据后,在8月15日一举逮捕10人。

- 涉及金额至今多少?

截至目前,涉及金额已超过28亿元,其中152个房地产和62辆汽车被发出禁止处置令,还有上千瓶酒。警方也扣押银行户头超过14亿5000万元存款,起获超过7600万元现金(包括外币)、68根金条、294个名牌包、164只名表、546件珠宝,以及价值超过3800万新元的虚拟货币。

- 当局如何处理扣押资产?

扣押的资产将根据法院判决出炉后依法处置。法院会在案件了结后展开财物分配研讯(disposal inquiry)。

- 永久居民和外国人购买的有地住宅有多少?

从2020年至2022年,当局批准让永久居民购买的本岛有地住宅共有109个。过去三年,土管局收到88份外国人购买升涛湾有地房产的申请,只有两份被拒。

- 当局如何侦查注册公司是否仍营业?

公司不活跃的明显迹象是没有提交年度报表。会计与企业管制局不会立即采取行动,但会继续观察。若这些公司在一段时间后仍不活跃,或当局接获其他情报,公司的注册资格就会被撤销。

- 当局如何侦测洗钱的可疑交易?

若发现可疑交易,相关者包括屋主、房地产商、金融机构和企业服务提供商等须提交报告给可疑交易报告办事处,否则可面对制裁。过去三年,办事处每年平均收到4万3000份可疑交易报告,超过80%由金融机构提交。

新加坡百亿洗钱案背后:网诈、赌博,「福建帮」的奢靡与罪恶

2023-09-26 20:55

8 月 15 日,新加坡接线报,出动超过 400 名来自商业事务局、刑事侦查局、警察部队的特别行动指挥处(Special Operations Command)和警察情报局的查案人员,在全国多个地方展开稽查行动,并于武吉知马、乌节路等超豪华别墅和公寓区逮捕 10 人。

同时,警方对价值约 8.15 亿新元的 94 处房产、50 辆汽车和一批名酒发出了禁止处置令,并查获了超过 1.1 亿新元存款的 35 个相关银行账户和 2300 万新元现金,以及 250 个奢侈品包和手表、270 多件珠宝首饰等奢侈品和 11 份虚拟资产信息文件。

随着调查的深入,警方捕获的总金额持续增加,94 处房产增加到 110 处,50 辆汽车增加至 62 辆,确定的涉案人数也从原来的 10 人增加到 34 人,已被扣押在银行户头的资金超过 55 亿,现金超过 3.8 亿,仅金条总数就有 68 根,虚拟资产金额达到 1.9 亿元。

被捕获的 10 名犯罪分子分别为苏海金(40岁)、苏宝林(41岁)、苏剑锋(35岁)、张瑞金(44岁)、林宝英(43岁)、王水明(42岁)、陈清远(33岁)、苏文强(31岁)、王宝森(31岁),以及王德海(34岁)。其中,张瑞金和林宝英为同居情侣关系。10 人原籍均为中国福建闽南地区,被知情人士称为福建帮,该帮派主要以姓氏宗族划分,苏姓、王姓、胡姓和陈姓是该帮派中的主要分支。

从国籍护照来看,仅有张瑞金、林宝英、王宝森为中国籍,其他均以其他国籍入境新加坡,其中陈清远、苏文强、苏宝林为柬埔寨籍;苏海金、王德海为塞浦路斯籍、王水明为土耳其籍、苏剑锋则是瓦努阿图籍。

目前,除了上述10人被控,相信还有24人是他们的关系人。根据新加坡警察部队之前的文告,有12人正在协助调查,八人被通缉。

实际上,10 人中已有 5 人被中国公安通缉。早在 2015 年,苏文强、王德海、苏剑锋就因一起网络赌博案被湖北桂阳县公安经办通缉。陈清远被福建安溪警方通缉的 115 名涉嫌诈骗的犯罪嫌疑人之列。王水明则是 8 月 15 日山东淄博警方捣毁的操作赌博网站、应用程序和网络赌博平台等活动的犯罪团伙之一。

在网络赌博领域,王水明的名号如雷贯耳。早在 12-13 年间,王水明就前往菲律宾从事博彩等网络赌博非法敛财,是首批前往菲律宾淘金的福建人,到 2016 年,王水明的名号逐渐传播,成为了该行业的资深大佬,人送外号「大明总」,众多门徒从福建前往菲律宾追随于他,其也不再满足于菲律宾有限的商业版图,开始逐渐发展其他集团与地区。

巅峰时期,有约 7-10 个网络赌博集团依附于他,集团通过分红给予王水明保护费,员工总人数达到了令人咂舌的 10000 多人,堪比知名大厂,不断输送博彩利益链。如其他企业一般,网络赌博平台同样设置主管部门、财务部门、运营与销售部门。新人起薪就可达到 1888 新币,试用期后即可涨至 2257 新币,而主管部门更是月薪可到 2-3 万元人民币,为绑定主管长期留存,集团通常会以股份分红制让渡给主管部门。

据线人透露,大约两年前,一个集团每月从注册赌徒那里就能收到 50 亿元人民币(9.4 亿新元)的赌金,单月员工总工资就可达到骇人的 1 亿元。而在王水明被捕后,这些网络赌场仍正常营运,原因是基层员工并不清楚幕后大佬究竟是谁,而不少集团的所有人已经开始仓皇逃窜,前往大本营菲律宾与柬埔寨。

相比低调的王水明,苏海金则更为高调。作为菲律宾网诈的另一头目,据《新加坡眼》称,苏海金社交能力极强,平日喜欢炫耀,喜爱组织 Party,不仅积极主动参与社会活动以提高知名度,新加坡总统慈善高尔夫球赛和多个社团的活动均有其赞助,其也有花费数万元购买社团名誉会长的头衔。17 年,苏海金便将妻子与妻子弟弟等一干人等移居至新加坡,而在新冠爆发后,苏海金的妻子还向家乡四川捐赠了大批口罩,将面子工程进行到底。

尽管目前名义上是塞浦路斯籍人,但实际上塞浦路斯护照政策早已在 2020 年被关闭,其在刑审中承认有 5 本护照,除中国与塞浦路斯外,还有柬埔寨、土耳其、圣卢西亚护照,其在柬埔寨、伦敦、澳门、塞浦路斯拥有总价值为总价值 7137.327 万元的房产,可谓是狡兔三窟。而在其被查获的圣卢西亚护照上名称与本人并不一致,护照名为苏俊杰,而非苏海金。

抓获苏海金的过程插曲颇多。据警方透露,当日警方进入其住所后先与其子交涉,而当其子带领警方来到苏海金房间敲门时,却无人回应,而房门也被从屋内上锁。破门而入后,苏海金已然不在屋内,在后续搜索中,警方搜寻到藏于沟渠中的苏海金,发现时其已手脚均已断裂,但其仍凭意志力离开住家并藏身于沟渠中,也正因此,警方认为其有严重的拒捕情节而不准予其保释。

在被逮捕的十人中,王水明已聘请律师,除极力申请保释的苏海金外,还有 5 名被告并不打算认罪,并有意要求保释。张瑞进称自己患有严重焦虑症,并有自杀倾向,要求法官批准保释,并声明可将其女友林宝颖继续关押防止串供,真正应验了一句「夫妻本是同林鸟,大难临头各自飞」。

从整体流程来看,该团伙通过在菲律宾、柬埔寨等地区从事网络赌场与网络诈骗,以此得到非法资金,并通过伪造文书等方式将钱款存至新加坡,最后完成洗钱闭环。由于情节恶劣,法院并未同意任何保释理由,根据新加坡法令,犯者一旦罪名成立将面对罚款最高 50 万元,或坐牢最长 10 年,或两者兼施,而伪造文件意图欺骗的罪名,一旦罪成将面对最长 10 年监禁,外加罚款。

该事件发生后,在新加坡引起轩然大波。在以法令严、处罚重,以鞭刑闻名的新加坡发生如此大型恶性事件实为罕见,不仅暴露出反洗钱手段与签证审查的不足,也让金融中心称号受损。不少本地人士对犯罪分子奢靡的生活表示愤怒,认为如此多的流动资金使得通货膨胀的压力让普通人承担,损害了国家与遵纪守法居民的利益。

对此,法律和内政部长尚穆根在接收《联合早报》采访时表示开放的门户难免进入苍蝇,回应道「我们需要非常严格,确保无人滥用金融制度,将新加坡变成洗钱天堂」,但其也认为新加坡声誉并未受损,「全球有数万亿钱在流动,并不是所有的钱都干净,但像我们这样的执法行动经常见到吗?」

对于犯罪人,尚穆根表示,被告一旦治罪,将在新加坡服刑,服完刑期后遣送回他所持护照的国家,或被送回跟新加坡有引渡协议的国家。但目前,中国与新加坡并无引渡协议。

对于后续款项的处理,有律师称根据现行法律,政府无权用查获的资产进行买卖交易或出租,但是等案件结束后展开财物分配研讯(disposal inquiry)后,这笔钱将会充公,而在充公前,若受害人可证明资产所有权,无论主体为何,外国人 / 公司 / 实体(entities)均可向新加坡法院申请归还。

2023.9.29 Three Arrows Capital co-founder Zhu arrested in Singapore airport

根据三箭资本联合清盘人 Teneo 确认的消息,三箭资本联合创始人 Zhu Su 在今天试图离开新加坡时,在樟宜机场被捕。此前,联合清盘人已向新加坡法院申请并获得了对 Zhu Su 的拘捕令,原因是他故意不服从法庭要求他配合清盘人进行调查的命令。

根据该拘捕令,Zhu Su 被判处4个月的监禁。同时,法院也对另一名三箭资本联创 Kyle Davies 发出了相似的逮捕令,但目前 Kyle Davies 下落不明。

三箭资本曾经是加密货币市场最大的对冲基金之一,在去年 Terra 生态系统崩溃后的几个月里陷入了困境,并于 2022 年 7 月申请破产。根据当时公布的文件,该公司欠其最大债权人超过 35 亿美元。

Three Arrows Capital co-founder Zhu arrested in Singapore airport, sentenced four months in prison

The hedge fund’s other co-founder Kyle Davies is also being called for arrest and imprisonment

10:36 PM GMT+8•September 29, 2023

The liquidators behind Three Arrows Capital (3AC), the now-defunct crypto hedge fund, shared that the firm’s co-founder Su Zhu was arrested in Singapore at the Changi Airport while trying to leave the country.

Teneo, a financial advisory firm controlling the liquidation and management of affairs for the defunct crypto hedge fund, said it got a “committal order” against Zhu after he failed to comply with court orders to cooperate with the liquidation investigation. The order sentenced Zhu to four months in prison, according to a statement.

The advisory firm added that a similar committal order was granted against the other 3AC co-founder, Kyle Davies, who is also being called for four month imprisonment. Davies’ whereabouts remain unknown, according to Teneo.

For context, the firm once managed an estimated $10 billion in assets and was a major entity among crypto market players. In July 2022, 3AC filed for Chapter 15 bankruptcy in New York.

The hedge fund’s prior insolvency forced major crypto players to rearrange their operations and limit customer withdrawals amid a crypto sell-off that seemed to catch plenty of mega firms off guard at the time, after the collapse of the Terra/LUNA project.

A Founder of the Crypto Hedge Fund Three Arrows Capital Is Arrested

Su Zhu, a founder of Three Arrows Capital, a cryptocurrency hedge fund that collapsed last year, was arrested in Singapore.

Sept. 29, 2023

Su Zhu, a founder of the cryptocurrency fund Three Arrows Capital, was arrested on Friday in Singapore while trying to leave the country, the liquidators of the company said.

Mr. Zhu, 36, was arrested at Changi Airport, the liquidators said. A Singaporean court on Monday had issued what are known as “committal” orders for Mr. Zhu and another Three Arrows founder, Kyle Davies, sentencing both to four months in prison after they failed to cooperate with the liquidators investigating their failed hedge fund. Mr. Davies’s location is unknown, according to Teneo, the firm that is working on the fund’s liquidation.

Last summer, Three Arrows, which is based in Singapore and managed $4 billion at its peak, filed for bankruptcy after the cryptocurrency markets melted down. When the fund collapsed, a large swath of the industry was dragged down with it. The ensuing crisis drained the savings of millions of amateur investors and plunged other companies into bankruptcy.

Mr. Zhu is the latest crypto executive to be arrested after the crypto market plunged last year.

In December, Sam Bankman-Fried, the founder of the crypto exchange FTX, was arrested in the Bahamas and later charged with orchestrating a sweeping fraud involving his company. His criminal trial begins in a federal court in Manhattan on Tuesday.

In March, Do Kwon, the founder of the crypto company Terraform Labs, was arrested in Podgorica, the capital of Montenegro, as he and a travel companion tried to board a private flight to Dubai, United Arab Emirates. He has also been charged with fraud.

A lawyer for Mr. Zhu didn’t immediately respond to a request for comment.

In a statement, Teneo said it would “pursue all opportunities” to ensure that Mr. Zhu “complies in full with the court order made against him for provision of information and documents” relating to Three Arrows during his imprisonment.