2024.4.26, San Gabriel Valley Woman Pleads Guilty to Counterfeit Postage Fraud that Caused More Than $150 Million in Losses to U.S. Postal Service

San Gabriel Valley Woman Pleads Guilty to Counterfeit Postage Fraud that Caused More Than $150 Million in Losses to U.S. Postal Service

Friday, April 26, 2024

For Immediate Release

U.S. Attorney’s Office, Central District of California

LOS ANGELES – A San Gabriel Valley woman pleaded guilty today to defrauding the United States Postal Service (USPS) out of more than $150 million by using counterfeit postage to ship tens of millions of parcels.

Lijuan “Angela” Chen, 51, of Walnut, pleaded guilty to one count of conspiracy to defraud the United States and one count of use of counterfeit postage. Chen has been in federal custody since her arrest in May 2023.

“This defendant participated in a fraud scheme that caused massive losses to our nation’s postal service,” said United States Attorney Martin Estrada. “My office will continue to focus on holding fraudsters accountable and bringing justice to victims everywhere.”

According to her plea agreement, from at least November 2019 to May 2023, Chen and her co-defendant, Chuanhua “Hugh” Hu, 51, owned and operated a package shipping business located in the City of Industry. This company provided shipping services, including the shipping of packages via U.S. Mail, for China-based logistics businesses.

To avoid the cost of postage, Hu began creating false and counterfeit postage to ship packages by printing duplicate and counterfeit Netstamps – stamps that may be purchased online from third-party vendors and printed onto adhesive paper.

In November 2019, knowing that law enforcement was investigating his use of counterfeit postage, Hu fled the United States and moved to China. After fleeing to China, Hu developed ways to make counterfeit postage and avoid detection, such as a computer program for fabricating counterfeit postage shipping labels. Chen remained in the United States and managed the warehouses that she and Hu used to ship mail bearing counterfeit postage.

Starting in 2020, Chen and Hu began affixing counterfeit postage to mail they presented to USPS for delivery. Chen and Hu received parcels from the China-based vendors and others, applied shipping labels showing postage purportedly paid and then arranged for the parcels to be transferred to USPS facilities to be shipped across the nation. The shipping labels were fraudulent and frequently included, among other red flags, “intelligent barcode data” recycled from previously mailed packages, according to court documents. Intelligent barcode data is used in some postage shipping labels to evidence the payment of required postage for the shipped item.

For example, on October 25, 2022, Chen and Hu caused to be transported to USPS a delivery of approximately 4,779 packages to be shipped via U.S. Mail. This delivery included multiple packages bearing counterfeit USPS Priority Mail postage meter stamps.

From January 2020 to May 2023, Chen and Hu knowingly mailed and caused to be mailed more than 34 million parcels containing counterfeit postage shipping labels, which caused more than $150 million in losses to USPS.

As part of her plea agreement, Chen has agreed to forfeit funds that law enforcement seized from her bank accounts, insurance policies, and real estate in Walnut, Chino, Chino Hills, South El Monte, Diamond Bar, and West Covina.

“The Postal Service and the Postal Inspection Service will continue to implement expanded measures to preserve the level of security Postal Service customers expect and deserve,” said Inspector in Charge Carroll Harris, Los Angeles Division of the Postal Inspection Service. “Engaging in counterfeit postage fraud causes monetary losses to customers and the Postal Service alike. Fraudsters beware, the Postal Inspection Service will continue to exhaust all its efforts to disrupt your scheme, find you, and bring you to justice.”

“Ms. Chen has admitted today that she conspired with Mr. Hu to defraud the United States Government willfully and knowingly,” said Special Agent in Charge Tyler Hatcher, IRS Criminal Investigation, Los Angeles Field Office. “IRS:CI will work tirelessly with our partners to protect taxpayer interests in the postal service and other government agencies.”

United States District Judge Josephine L. Staton scheduled an August 2 sentencing hearing, at which time Chen will face a statutory maximum sentence of five years in federal prison for each count.

Hu, who is believed to be a fugitive residing in China, is charged with one count of conspiracy to defraud the United States, three counts of passing and possessing counterfeit obligations of the United States, and one count of forging and counterfeiting postage stamps.

An indictment is merely an allegation, and the defendant is presumed innocent unless and until proven guilty beyond a reasonable doubt in a court of law.

The United States Postal Inspection Service and IRS Criminal Investigation investigated this matter.

Assistant United States Attorneys James C. Hughes and Richard E. Robinson of the Major Frauds Section are prosecuting this case.

—

Southern California woman pleads guilty in $150-million counterfeit postage scheme

A San Gabriel Valley woman who was accused of using counterfeit postage on tens of millions of packages pleaded guilty Friday to defrauding the United States Postal Service out of more than $150 million.

Lijuan “Angela” Chen, 51, pleaded guilty to one count of conspiracy to defraud the U.S. and one count of using counterfeit postage, according to a statement from the U.S. Justice Department.

Chen, a resident of Walnut, has been in federal custody since she was arrested in May 2023. A co-defendant, 51-year-old Chuanhua “Hugh” Hu — who authorities say is considered a fugitive hiding in China — has been charged with one count of conspiracy to defraud the U.S., three counts of passing and possessing counterfeit obligations of the U.S. and one count of forging and counterfeiting postage stamps.

In all, authorities allege that the duo mailed more than 34 million parcels containing counterfeit postage labels from January 2020 through last May.

According to Chen’s plea agreement, she and Hu owned and operated a City of Industry-based package shipping company that offered shipping by U.S. Mail for China-based logistics businesses.

Hu then began to print duplicate and counterfeit NetStamps in an effort to cut the cost of postage, authorities allege.

In November 2019, officials say, Hu became aware that federal authorities were investigating, so he fled to China, where he continued to create counterfeit postage and avoid detection. Federal authorities believe he used a computer program to fabricate shipping labels.

Meanwhile, Chen remained in the San Gabriel Valley, managing the warehouses the two used to ship packages for their business. The pair then began using counterfeit postage to ship items by U.S. Mail in 2020. Authorities say they would receive packages from China-based companies and apply the fake postage to ship them through the Postal Service.

According to court documents, the red flags raised by fake postage included the reuse of “intelligent barcode data” already applied to other mailed packages. Those data are used to prove the labels have been paid for prior to shipping.

Multiple packages shipped by Chen and Hu included counterfeit Priority Mail postage, authorities said.

Under the terms of Chen’s plea agreement, she will forfeit funds in her bank accounts, insurance policies and real estate in Chino, Chino Hills, Diamond Bar, South El Monte, Walnut and West Covina. She is scheduled to be sentenced in August, and faces up to five years in prison for each count.

“This defendant participated in a fraud scheme that caused massive losses to our nation’s postal service,” U.S. Atty. Martin Estrada said in a statement. “My office will continue to focus on holding fraudsters accountable and bringing justice to victims everywhere.”

—

洛華女詐騙超1.5億 多處房產被沒收 丈夫潛逃中國

洛杉磯縣聖蓋博谷(San Gabriel Valley)一名華人女子,日前承認偽造郵資(counterfeit postage)詐騙罪,對美國郵政局(USPS)造成超過1.5億元。她的同犯、也是她的丈夫,已潛逃回中國;夫妻倆在南加華人區擁有多處房產,均已被沒收。

根據加州中區檢察官辦公室(U.S. Attorney’s Office Central District of California)訊息,51歲的陳麗娟(Lijuan “Angela”Chen,音譯)4月26日認罪,承認使用假郵資運送數千萬個包裹,詐騙郵局超過1.5億的巨額資金。陳麗娟來自核桃市(Walnut),自2023年5月被捕以來,她一直被聯邦拘留。

作為認罪協議的一部分,陳麗娟同意執法部門沒收她的銀行帳戶、保險單以及多處房產;這些房產分別位於核桃市、奇諾市(Chino)、奇諾岡(Chino Hills)、南艾爾蒙地市(South El Monte)、鑽石吧(Diamond Bar)、以及西柯汶那市(West Covina)等城市。

根據陳麗娟的認罪內容,51歲的丈夫胡傳華(Chuanhua “Hugh” Hu)是同犯, 2019年11月至2023年5月期間,兩人在工業城(City of Industry)擁有並經營一家包裹運輸公司,該公司為中國物流企業提供運輸服務,包括透過美國郵政運送包裹。為逃避郵資成本,胡傳華透過偽造的Netstamps郵票,製造虛假郵資運送包裹;Netstamps是一種可以從第三方供應商在線購買,並印在不干膠紙上的郵票。

2019年11月,胡傳華得知執法部門正在調查他的違法行為,隨即逃往中國,並在中國繼續研究製作假郵資並逃避檢測的方法。例如使用電腦程式偽造運輸標籤。期間,妻子陳麗娟則留在洛杉磯,管理兩人用來運送假郵資郵件的倉庫。

從2020年開始,夫妻倆開始在USPS投遞的郵件上貼假郵資。他們從一些中國供應商接收包裹後,貼上顯示已付郵資的運輸標籤,然後將這些包裹轉移到美國郵政局,以便運往全國各地。法庭文件顯示,這些運輸標籤充滿欺詐性,包含從先前郵寄的包裹中回收的「智慧條形碼」;一些郵資運輸標籤中使用智慧條形碼,證明已支付運輸物品所需的費用。

例如,2022年10月25日,陳麗娟、胡傳華兩名嫌犯將4779個包裹透過郵局運送,大多包裹均貼有偽造的USPS Priority Mail郵資計價郵票。2020年1月至2023年5月,兩人共郵寄超過3400萬個含有假郵資運輸標籤的包裹,給郵政局造成超過價值1.5億元的損失。

嫌犯在USPS投遞的郵件上貼假郵資,運往全美各地。圖為示意圖。

華人夫妻偽造郵資,對USPS造成超過1.5億元的損失。圖為示意圖。

據悉,陳麗娟量刑聽證會將於8月2日舉行,每項罪名將面臨長達5年監禁。同案犯胡傳華仍在逃中國,他被控串謀詐騙聯邦機構、傳播和持有偽造托運義務(counterfeit obligations)、以及偽造郵票罪。美國郵政局和國稅局刑事調查局正對此案進行調查。檢察官Martin Estrada指出,被告參與詐騙計畫,對國家郵政服務造成巨大損失,執法部門將繼續致力追究欺詐者責任,為受害者伸張正義。

2024.4.18, Suspect arrested for defrauding the elderly

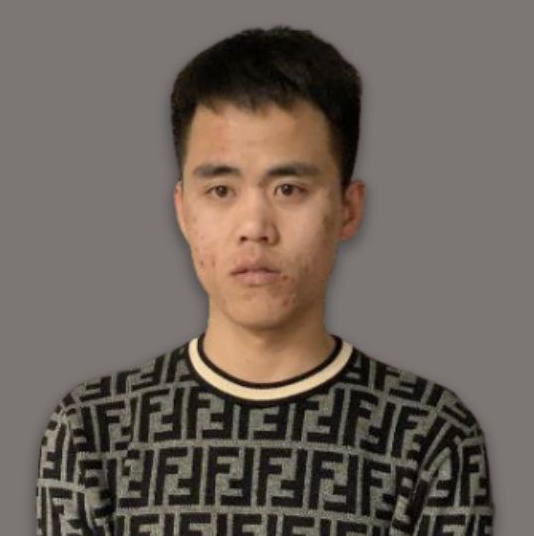

The suspect was identified as Huiming Yu, a 27-year-old male from the city of Alhambra. He was subsequently arrested for PC 532(a) – Theft by False Pretenses and booked at the West Valley Detention Center.

Ontario Police Department, California

Thursday April 18th, 2024 :: 05:14 p.m. PDT

Suspect arrested for defrauding the elderly

Ontario, CA – The ORION Taskforce has arrested a suspect for defrauding the elderly and returned approximately $500,000 to identified fraud victims.

The Ontario Regional Interdiction of Narcotics (ORION) Taskforce is made up of officers from the Ontario and Upland Police departments. Together, they work to combat financial fraud and illegal narcotics being shipped across the country.

In late January of 2024, ORION Taskforce Officers intercepted fraud-related packages shipped from all over the country to several Southern California drug stores. Through their investigation, Taskforce Officers learned the receivers’ names on the packages were false and that the elaborate scheme also involved financially defrauding elderly victims, by having the victims ship money to the suspect after false promises were made. These false promises included telling victims their computer was hacked or they needed protection from the FBI and to resolve these issues, they needed to ship money to the suspect.

The suspect was identified as Huiming Yu, a 27-year-old male from the city of Alhambra. He was subsequently arrested for PC 532(a) – Theft by False Pretenses and booked at the West Valley Detention Center.

There are believed to be over 30 victims and because of the Taskforce’s work, approximately $500,000 has been returned to the victims thus far.

We want to remind our communities to stay vigilant. Protect yourself from fraud by verifying identities by doing research, avoid unsolicited offers, and to seek advice if unsure. Report all suspicious activity to the police immediately.

Anyone with information is asked to contact the Ontario Police Department at (909) 986-6711 or Officer Jose Valencia at (909) 408-1606. Information can be reported anonymously by calling WE-TIP at 800-78-CRIME or online at www.wetip.com.

Address/Location

Ontario Police Department, California

2500 S Archibald Ave

Ontario, CA 91761

Contact

Emergency: 9-1-1

Non-emergencies: 909-395-2001

—

Southern California man busted for scamming elderly victims out of $500K

Posted: Apr 18, 2024

A 27-year-old man from the San Gabriel Valley has been arrested after allegedly defrauding elderly victims of more than $500,000, authorities announced Thursday.

The investigation into Alhambra resident Huiming Yu began in late January when detectives with the Ontario Police Department’s Regional Interdiction of Narcotics Task Force intercepted fraud-related packages sent from across the country to several Southern California drug stores, according to a department news release.

Investigators learned that the receivers’ names on the packages were false and that the elaborate scheme targeting elderly victims involved telling them their computer had been hacked and that they needed protection from the Federal Bureau of Investigation, for a fee, to resolve these matters.

The victims would then ship money to Yu based on the false promises he made.

Yu was arrested and booked at the West Valley Detention Center on charges of theft by false pretense.

Authorities believe there were more than 30 victims of the scam and have, so far, been able to return some $500,000 in stolen funds to those who were defrauded.

“We want to remind our communities to stay vigilant,” the release stated. “Protect yourself from fraud by verifying identities, doing research, avoiding unsolicited offers and seeking advice if unsure. Report all suspicious activity to the police immediately.”

Anyone with information about this investigation is asked to contact the Ontario Police Department at 909-986-6711 or Officer Jose Valencia at 909-408-1606.

Those wishing to remain anonymous can call the WeTip Hotline at 800-78-CRIME or leave tips online at WeTip.

—

詐騙長者逾三十人 南加華裔男子被捕

2024-04-20

當局本週宣布,一名來自聖蓋博谷的27歲華裔男子因涉嫌詐騙老年受害者超過50萬元而被逮捕。

KTLA 5電視新聞報道,安大略市警局指出,針對阿罕布拉市居民余慧明(Huiming Yu音譯)的調查始於1月下旬。

當時,地區緝毒工作小組的警探截獲了從全國各地發送到南加州幾間藥店的詐欺包裹。

調查人員了解到,包裹上的收件人姓名是虛假的,嫌犯專以老年人為下手目標,謊稱他們的電腦遭到駭客入侵,需要聯邦調查局付費保護才能解決問題。

余因涉嫌詐欺罪名被逮捕,並被關押在西谷看守所。

警方相信該場騙局至少有超過30名受害者,截至目前為止,警方已向受騙者返還約50萬的被騙現金。

新聞稿稱:「希望社區居民能保持警惕,透過驗證身分、深入了解、拒絕可疑報價以及尋求專業建議等措施保護自身免受詐欺,同時立即向警方通報所有可疑活動。」

知情者或受害者請聯繫安大略市警局:(909)986-6711或警官Jose Valencia:(909)408-1606。希望保持匿名者則可撥打WeTip熱線:800-78-CRIME或在www.wetip.com線上留言。

—

30位老人上当,受骗金额超$50万!洛杉矶华裔因诈骗被捕!

近日,一名来自洛杉矶华人区圣盖博谷(San Gabriel Valley)的27岁男子因涉嫌诈骗老年人50多万美元而被捕。

安大略警局称,对阿罕布拉居民 Huiming Yu 的调查始于1月下旬。当时,该警察局区域禁毒特遣部队(Regional prohibition of Narcotics Task Force)的侦探截获了从全美各地寄往南加州几家药店的与欺诈有关的包裹。

调查人员了解到,包裹上收款人的名字是假的,背后是一场针对老年人的经济诈骗。嫌犯告诉这些受害者,他们的电脑遭到了黑客攻击,他们需要联邦调查局的保护,并收取费用来解决这些问题。

然后,受害者会根据 Yu 的虚假承诺,把钱寄给他。

目前,Yu 已被逮捕,罪名是欺诈。

有关部门认为,这一骗局的受害人超过30个,到目前为止,已经能够将大约50万美元的被盗资金归还给受害人。

警方表示:“我们想提醒我们的社区保持警惕。通过验证身份、进行调查、避开主动提供的服务,以及在不确定的情况下寻求建议来保护自己免受欺诈。立即向警方报告所有可疑活动。”

2024.4.18, A Manhattan jury has found crypto trader Avi Eisenberg guilty of fraud and market manipulation for his $110 million heist from decentralized finance protocol Mango Markets in October 2022. Eisenberg was arrested in Puerto Rico in December 2022 and charged with commodities fraud, commodities manipulation, and wire fraud for the scheme. He will be sentenced on July 29 by New York District Court Judge Arun Subramanian. Eisenberg faces up to 20 years in federal prison for his crimes.

PRESS RELEASE

Man Convicted for $110M Cryptocurrency Scheme

Thursday, April 18, 2024

For Immediate Release

Office of Public Affairs

Justice Department’s First Cryptocurrency Open-Market Manipulation Case

A federal jury in New York convicted a man residing in Puerto Rico today of commodities fraud, commodities market manipulation, and wire fraud in connection with the manipulation on the Mango Markets decentralized cryptocurrency exchange.

According to court documents and evidence presented at trial, Avraham Eisenberg, 28, engaged in a scheme to fraudulently obtain approximately $110 million worth of cryptocurrency from Mango Markets and its customers by artificially manipulating the price of certain perpetual futures contracts.

“Avraham Eisenberg executed a manipulative trading scheme on a cryptocurrency exchange, defrauding the exchange and its investors out of $110 million,” said Principal Deputy Assistant Attorney General Nicole M. Argentieri, head of the Justice Department’s Criminal Division. “Manipulative trading puts our financial markets and investors at risk. This prosecution—the first involving the manipulation of cryptocurrency through open-market trades—demonstrates the Criminal Division’s commitment to protecting U.S. financial markets and holding wrongdoers accountable, no matter what mechanism they use to commit manipulation and fraud.”

“Moments ago, Avraham Eisenberg was found guilty by a unanimous jury in the first-ever cryptocurrency open-market manipulation case,” said U.S. Attorney Damian Williams for the Southern District of New York. “This ground-breaking prosecution epitomizes this office’s ability to employ innovative methods and cutting-edge law enforcement tools to continue to protect all financial markets. The career prosecutors of this office continue their expertise in prosecuting financial fraud, one of our core priorities, and would-be financial criminals should think twice before daring to engage in illicit conduct on our watch.”

“The FBI and its partners will not stand by when criminals engage in illicit activity at the expense of the American people and our financial institutions,” said Executive Assistant Director Timothy Langan of the FBI’s Criminal, Cyber, Response, and Services Branch. “If you engage in fraudulent activity, whether that be in the cryptocurrency space or through other forms of market manipulation, you will be held accountable for your ill-gotten gains.”

Eisenberg is scheduled to be sentenced on July 29 and faces a maximum penalty of 10 years in prison on the commodities fraud count and the commodities manipulation count, and a maximum penalty of 20 years in prison on the wire fraud count. A federal district court judge will determine any sentence after considering the U.S. Sentencing Guidelines and other statutory factors.

The FBI investigated the case, with assistance from Homeland Security Investigations and IRS Criminal Investigation.

Trial Attorney and Special Assistant U.S. Attorney Tian Huang of the Criminal Division’s Fraud Section, a member of the National Cryptocurrency Enforcement Team (NCET), and Assistant U.S. Attorneys Thomas Burnett and Peter Davis for the Southern District of New York are prosecuting the case.

The NCET was established to combat the growing illicit use of cryptocurrencies and digital assets. Within the Criminal Division’s Computer Crime and Intellectual Property Section, the NCET conducts and supports investigations into individuals and entities that are enabling the use of digital assets to commit and facilitate a variety of crimes, with a particular focus on virtual currency exchanges, mixing and tumbling services, and infrastructure providers. The NCET also works to set strategic priorities regarding digital asset technologies, identify areas for increased investigative and prosecutorial focus, and lead the department’s efforts to collaborate with domestic and foreign government agencies as well as the private sector to aggressively investigate and prosecute crimes involving cryptocurrency and digital assets.

—

Mango Markets Exploiter Avi Eisenberg Found Guilty of Fraud and Manipulation

Eisenberg faces up to 20 years in prison for his $110 million heist.

NEW YORK – A Manhattan jury has found crypto trader Avi Eisenberg guilty of fraud and market manipulation for his $110 million heist from decentralized finance protocol Mango Markets in October 2022.

Eisenberg was arrested in Puerto Rico in December 2022 and charged with commodities fraud, commodities manipulation, and wire fraud for the scheme. He will be sentenced on July 29 by New York District Court Judge Arun Subramanian. Eisenberg faces up to 20 years in federal prison for his crimes.

“This ground-breaking prosecution epitomizes this office’s ability to employ innovative methods and cutting-edge law enforcement tools to continue to protect all financial markets,” said Damian Williams, U.S. Attorney for the Southern District of New York, in a Thursday press statement. “The career prosecutors of this office continue their expertise in prosecuting financial fraud, one of our core priorities, and would-be financial criminals should think twice before daring to engage in illicit conduct on our watch.”

During his trial in New York’s Southern District, Eisenberg’s defense attempted to frame his trades on Mango Markets as “successful and legal,” arguing that they “fully complied” with the decentralized protocol’s scanty rules at the time of the heist.

But the 12-person jury didn’t buy it, instead siding with prosecutors’ arguments that Eisenberg’s actions constituted “brazen” fraud and manipulation.

Eisenberg is the latest crypto figure to be convicted of fraud, following shortly on the heels of FTX founder Sam Bankman-Fried’s conviction and subsequent 25 year sentence for his role in the collapse of FTX, and Terraform Labs co-founder Do Kwon being found liable for fraud in civil fraud case against him earlier this month.

On October 11, 2022, Eisenberg made three massive MNGO perpetual futures trades between himself, pumping the price over 1000% and then using his newly-created collateral to trick the protocol into allowing him to “borrow” $110 million in various cryptocurrencies.

But Eisenberg wasn’t “borrowing,” he was stealing – hours after the exploit, he posted an anonymous proposal to the Mango Markets decentralized autonomous organization (DAO) offering to return $67 million of his ill-gotten gains in exchange for a promise not to pursue charges against him and permission to pocket the rest.

Though Eisenberg’s defense team, headed by well-known crypto defense lawyer Brian Klein, argued that Eisenberg was acting within the law, prosecutors showed the jury a bucket of evidence – including internet searches for things like “statute of limitations market manipulation” and “FBI surveillance” and “elements of fraud” and his flight to Israel after his identity as the exploiter was unmasked – suggesting he knew his actions were criminal.

“We’re obviously disappointed, but we will keep fighting for our client,” Klein told CoinDesk. “We plan to file a number of post-trial motions.”

—

美法院判定 Mango 协议漏洞利用者 Avraham Eisenberg 犯下诈欺罪

2024/04/19

美法院判定 Mango 协议漏洞利用者 Avraham Eisenberg 犯下诈欺罪

根据彭博社报导,在美国首件涉及加密货幣操纵相关刑事指控的审判中,被控利用 Solana 生態去中心化金融平台 Mango Markets 的漏洞窃取 1.1 亿美元的交易员 Avraham Eisenberg 被判犯有诈欺罪。

纽约的联邦陪审员週四(18日)认定 Avraham Eisenberg 因其在 2022 年 10 月 11 日的交易行为而犯有商品诈欺、商品操纵和电信诈欺罪,判决定於 7 月 29 日进行。他在电信诈欺罪上面临 20 年的监禁,在其他指控上分別面临 10 年监禁。

检察官指控自称为「应用博弈理论家」的 Eisenberg 使用假身份在 Mango Markets 上进行交易,拉抬了 Mango 原生代幣 MNGO 的价格以及永续期货合约,隨后利用该平台的一项允许他「借入」其持有的资產,提取了价值 1.1 亿美元的加密货幣,而他並无意偿还。据此前报导,Eisenberg 后来与 Mango DAO 协商,同意归还 6700 万美元的资金。

检方表示,Eisenberg「抬高」了 MNGO 代幣的价格,让他得以对 Mango Markets 实施其预谋数週的诈欺行为,「他打算拿了钱就跑」。判决后,Eisenberg 的律师 Brian Klein 在一份声明中表示:「我们显然很失望,但我们將继续为我们的客户而战。我们计划提出一系列审后动议。」

Klein 表示他的当事人执行了一个完全合法的策略,「完全遵守」控制 Mango Markets 的智能合约,该平台只对用户警告称「这是未经审计的软体,使用风险自负」。但美国助理检察官 Thomas Burnett 表示,Mango Markets 的平台规则並不能保护 Eisenberg 免受诈欺和操纵行为的起诉。

2024.4.17, Two people were arrested in Plano for an alleged gift card scheme involving several North Texas stores.

Plano police arrested Xiaohong Zhang and Xiongling Chen, both of California, last week in connection to the scheme.

California duo arrested in Plano for alleged ‘gift-card draining’ scheme

April 17, 2024

PLANO, Texas – Two people were arrested in Plano for an alleged gift card scheme involving several North Texas stores.

Plano police arrested Xiaohong Zhang and Xiongling Chen, both of California, last week in connection to the scheme.

Police say it’s a scam called “gift card draining.”

It involves scammers grabbing unpurchased gift cards from service kiosks and getting the card numbers and PIN codes.

Once the scammers get the information, they reseal the cards and put them back on the shelves.

Then, when someone buys a tampered card, the scammer drains all of the money from the prepaid card.

Plano police say they worked with the Secret Service and ICE to investigate the scam across the DFW area. Through surveillance, they say Zhang and Chen were seen placing tampered gift cards back in store Kiosks across several North Texas stores, including in Plano.

Plano police seized 4,100 tampered Apple gift cards valued at $649,000 in connection to the scheme.

“The Plano Police Department encourages the public to be vigilant when purchasing gift cards and to report any suspicious activity to the authorities,” the department said in a press release. “Consumers should inspect gift cards prior to purchase and notify staff if anything appears out of the ordinary. It’s also important to keep the receipt as proof of purchase.”

Anyone who thinks they bought a tampered gift card can contact the retailer where they bought it. They can also file a report with police and the FTC.

Zhang and Chen are each charged with unlawful use of a criminal instrument.

Police say more arrests are forthcoming.

—

盜刷65萬元 2加州華人德州落網

遭到逮捕的Xiongling Chen(左)與Xiaohong Zhang(右)。(科林縣監獄提供)

德州布蘭諾市警局近日逮捕兩名來自加州的華人,男的名為陳雄林(音譯,Xiongling Chen),女的是張小虹(音譯,Xiaohong Zhang),因為他們涉及德州北部多商店的禮物卡盜刷事件,兩人的罪名都是不法使用犯罪工具。

警方與特勤局(Secret Service)、移民局(ICE)合作,在達拉斯-福和市地區(Dallas-Fort Worth)追查「刷光卡片」(Gift Card Draining)的犯罪集團,逮捕兩人時起出4100張Apple禮物卡,總價達64萬9000元。警方說還有後續收網行動。

這類犯罪手法是,嫌犯先在店內取得還沒賣出的禮物卡,並取得卡號與PIN碼後,再還原包狀放回貨架。一旦有人買卡,歹徒就會先領光卡內金額。在跟監多日之後,警方確定陳男與張女在多家店內都有放回卡片的行為,因此逮捕兩人。

市警局呼籲,民眾購買禮物卡時應提高警覺,在使用前確認卡片沒有被動手腳,也應該保留購買收據,一旦發現可疑跡象就應向執法單位通報。認為自己可能賣到問題卡的民眾可以聯絡零售商,也可以向警方或聯邦貿易委員會(FTC)通報。

2024.4.15, Montrealer who stole millions with fake psychic fraud is sentenced to 10 years in U.S. prison

The U.S. Justice Department says Patrice Runner, 57, used a Montreal company to steal more than $175 million from 1.3 million people in the U.S. between 1994 and 2014.

PRESS RELEASE

Canadian Man Sentenced for Operating $175M Psychic Mass-Mailing Fraud Scheme

Monday, April 15, 2024

For Immediate Release

Office of Public Affairs

Scheme Defrauded Over 1.3 Million Victims in the United States

A Canadian man was sentenced to 10 years in prison today in the Eastern District of New York for perpetrating a massive psychic mass-mailing fraud scheme that stole more than $175 million from more than 1.3 million victims in the United States.

Following a two-week trial, a federal jury convicted Patrice Runner, 57, a Canadian and French citizen, in June 2023 of conspiracy to commit mail and wire fraud, conspiracy to commit money laundering and multiple counts of mail fraud and wire fraud.

Runner operated a mass-mailing fraud scheme from 1994 through November 2014. As part of the scheme, Runner sent letters to millions of U.S. consumers, many of whom were elderly and vulnerable. The letters falsely purported to be individualized, personal communications from well-known so-called “psychics” Maria Duval and Patrick Guerin and promised that the recipient had the opportunity to achieve great wealth and happiness with the assistance of the “psychics” in exchange for payment of a fee. Once a victim made a single payment in response to one of the letters, the victim was bombarded with dozens of additional letters, all purporting to be personalized communications from the “psychics” and offering additional services and items for a fee.

Although the scheme’s letters frequently stated that a “psychic” had seen a personalized vision regarding the recipient of the letter, in fact, the scheme sent nearly identical form letters to tens of thousands of victims each week. Runner and his co-conspirators obtained the names of elderly and vulnerable victims by renting and trading mailing lists with other mail fraud schemes. In reality, Duval and Guerin had no role in sending the letters, did not receive responses from the victims, and did not send the additional letters after victims paid money. In fact, no “psychics” played any role in Runner’s operation. Some victims made dozens of payments in response to the fraudulent letters, losing thousands of dollars.

Runner directed the scheme for the entirety of its twenty-year operation, directing co-conspirators, who ran the day-to-day operations of the scheme through a Canadian company. Runner used a series of shell companies registered in Canada and Hong Kong to hide his involvement in the scheme while living in multiple foreign countries, including Switzerland, France, the Netherlands, Costa Rica and Spain.

Spanish authorities extradited Runner to the United States to face federal charges in December 2020.

“This case demonstrates that the Justice Department’s Consumer Protection Branch and its partners in the U.S. Postal Inspection Service (USPIS) are committed to investigating and prosecuting transnational fraud schemes targeting Americans consumers,” said Principal Deputy Assistant Attorney General Brian M. Boynton, head of the Justice Department’s Civil Division. “The global nature of this scheme meant that we had to rely on law enforcement from around the globe to provide evidence of criminality. We want to thank officials from France, Liechtenstein, Switzerland and Canada, and in particular the Canadian Competition Bureau, for providing assistance in securing evidence in this matter, as well as Spain for arresting and extraditing Runner, ensuring that justice could be done.”

“Patrice Runner’s extravagant lifestyle, born on the backs of millions of older and vulnerable Americans, has come to an end,” said Inspector in Charge Chris Nielsen of the USPIS Philadelphia Division. “The conviction and federal sentencing of Patrice Runner is the appropriate punishment for someone who routinely preyed on vulnerable and elderly Americans. Postal Inspectors will continue to work tirelessly to ensure you can trust that the US Mail is free of these types of predatory schemes.”

Four other co-conspirators previously pleaded guilty to conspiracy to commit mail fraud in connection with this mass-mailing fraud scheme: Maria Thanos, 60, of Montreal, Canada; Philip Lett, 53, of Montreal; Sherry Gore, 73, of Indiana, and Daniel Arnold, 62, of Connecticut.

USPIS investigated the case.

Assistant Director John W. Burke and Trial Attorneys Charles B. Dunn, Rachel Baron and Ann Entwistle of the Civil Division’s Consumer Protection Branch prosecuted the case. The Justice Department’s Office of International Affairs provided critical assistance in securing Runner’s extradition.

The department urges individuals to be on the lookout for fraudulent “psychic,” lottery, prize notification and sweepstakes scams. If you receive a phone call, letter or email promising a large prize in exchange for a fee, do not respond. Fraudsters often will use official-sounding names or the names of real lotteries or sweepstakes, or pretend to be a government agent purportedly helping to secure a prize.

If you or someone you know is age 60 or older and has experienced financial fraud, experienced professionals are standing by at the National Elder Fraud Hotline: 1-833-FRAUD-11 (1-833-372-8311). This Justice Department hotline, managed by the Office for Victims of Crime, can provide personalized support to callers by assessing the needs of the victim and identifying relevant next steps. Case managers will identify appropriate reporting agencies, provide information to callers to assist them in reporting, connect callers directly with inappropriate agencies and provide resources and referrals, on a case-by-case basis. Reporting is the first step. Reporting can help authorities identify those who commit fraud and reporting certain financial losses due to fraud as soon as possible can increase the likelihood of recovering losses. The hotline is open Monday through Friday from 10:00 a.m. to 6:00 p.m. ET. English, Spanish and other languages are available.

—

Canadian con artist sentenced to 10 years for $175M psychic mail fraud in U.S.

Across 20 years, Canadian Patrice Runner conned over 1.3 million Americans out of more than US$175 million (more than C$241 million) by posing as a mail-in psychic — but his phony premonitions never anticipated a 10-year prison sentence in the U.S.

Runner, who previously lived in Montreal, was handed his 10-year sentence in the Eastern District of New York on Monday, according to a press release from the U.S. Department of Justice (DOJ).

The 57-year-old was convicted in June 2023. He was found guilty on 14 charges including conspiracy to commit mail and wire fraud, eight counts of mail fraud, four counts of wire fraud and conspiracy to commit money laundering.

Runner, who also possesses French citizenship, ran his psychic mail scheme alongside other co-conspirators from 1994 through November 2014. He sent letters to millions of Americans while pretending to be either Maria Duval or Patrick Guerin, both of whom are well-known “psychics.” (Duval and Guerin were not involved in sending the letters, the DOJ claimed.)

Runner’s fraudulent mail promised Americans an opportunity to “achieve great wealth and happiness with the psychic’s assistance, in exchange for payment of a fee.” Many of the letters claimed the psychic had seen a vision specifically about the recipient.

The DOJ said Runner’s scheme preyed specifically on victims who were “elderly and vulnerable.”

Nearly identical letters were sent to tens of thousands of victims each week.

Once Runner had a victim who took the bait, he and his co-conspirators would inundate them with dozens more letters, again claiming to offer personalized services or products for further payment.

“Some victims made dozens of payments in response to the fraudulent letters, losing thousands of dollars,” the DOJ wrote.

Then, after 20 years of leading the mail fraud operation, Runner was arrested in Ibiza in 2020.

He was extradited to the U.S. from Spain that same year.

In a 2023 interview with The Walrus, Runner maintained he’d never done anything illegal.

“Maybe it’s not moral, maybe it’s bulls—t,” he said. “But it doesn’t mean it’s fraud.”

Speaking from a New York detention centre, Runner said the “most lucrative years” for his scheme were between 2005 and 2010. He claimed to have once made US$23 million (over C$31 million) in a single year.

“I used to live like a rock star,” Runner said. “I was not cautious enough. I thought the mail-order business would be forever.”

“Patrice Runner’s extravagant lifestyle, born on the backs of millions of older and vulnerable Americans, has come to an end,” said Chris Nielsen of the USPIS Philadelphia Division. “The conviction and federal sentencing of Patrice Runner is the appropriate punishment for someone who routinely preyed on vulnerable and elderly Americans.”

“Postal Inspectors will continue to work tirelessly to ensure you can trust that the US Mail is free of these types of predatory schemes,” Nielsen promised.

Runner’s company ran its day-to-day direct-mail operations out of Montreal.

He and his co-conspirators gathered the names of elderly and vulnerable victims through a criminal circle renting and trading in mailing lists for the purpose of fraud.

To mask his scheme, the DOJ said Runner used a series of shell companies registered in Canada and Hong Kong.

While hiding from the law, Runner lived in countries including Switzerland, France, the Netherlands, Costa Rica and Spain.

Four of his co-conspirators have already pleaded guilty to conspiracy to commit mail fraud in connection to the scheme. Among them are Maria Thanos and Philip Lett, both from Montreal.

Before his arrest, Runner was found guilty and fined for orchestrating two other scams. One saw him falsely advertise a clairvoyant who could predict winning lottery numbers, and in another, Runner hocked phony weight loss products.

How to protect yourself from mail fraud

Canadians should be wary of any fraudulent lottery, prize notifications and sweepstakes scams that may arrive in the mail (or by phone).

Innovation, Science and Economic Development Canada, a government body that seeks to strengthen a fair marketplace, encourages citizens to deal with only registered companies or charities.

You should never trust unsolicited offers requiring your credit card number or banking information, or requests for you to call a 1-900 number.

Concerned Canadians can contact your provincial or territorial consumer affairs office or the Better Business Bureau to find out if the business is registered and if there have been any complaints against the company.

—

Montrealer who stole millions with fake psychic fraud is sentenced to 10 years in U.S. prison

The U.S. Justice Department says Patrice Runner, 57, used a Montreal company to steal more than $175 million from 1.3 million people in the U.S. between 1994 and 2014.

A former Montreal resident was sentenced earlier this week to 10 years in a United States federal prison for a multi-decade fraud that manipulated more than one million Americans into sending money to fake psychics.

Patrice Runner, 57, was convicted of 14 charges, including mail fraud and wire fraud, in June 2023 after a trial in a New York Federal Court.

Runner, a Canadian and French citizen, was found to have stolen more than $175 million from 1.3 million people in the U.S. between 1994 and 2014 by sending letters promising psychics would help them achieve wealth and happiness in exchange for a fee, the U.S. Justice Department said in a statement Monday.

In their sentencing recommendation, prosecutors said that on average Runner “defrauded more than 7,000 victims per week. Seven thousand victims would be notable in any case — but for Runner, that was only seven days’ work out of more than 20 years.”

“He did nothing else; he possesses no other skills. Runner was a full-time fraudster for decades.”

Runner used a Montreal company to send the letters to people across the U.S. and Canada. Each one claimed to be a personal communication from “so-called ’psychics’ Maria Duval and Patrick Guérin,” according to the Justice Department. However, no purported psychics were involved in the operation and the personalized letters were nearly identical forms sent to people whose names were obtained from mailing lists created by other con artists.

People who sent money would receive dozens of additional letters offering to sell them more services and items with supposed magical powers.

Prosecutors had sought a 30-year sentence for Runner, a former Montrealer, who directed the scheme from a number of countries before he was arrested in Spain, from where he was extradited to the U.S. in 2020.

“Runner took total advantage of his victims and their desperation, millions of times. Each of those more than six million victim payments represents a person reaching out for help that never came and that Runner never even tried to provide. Runner promised his victims easy, magical answers in exchange for a fee, and provided nothing in return except a cheap, fake trinket,” prosecutors wrote.

Runner’s defence lawyer had sought a five-year sentence, arguing that many of his client’s “customers” didn’t feel that they had been ripped off and that of those who did the vast majority lost no more than $40.

“The government has portrayed Patrice Runner as greedy, cynical, and heartless. He is none of those things,” James Darrow, an assistant federal defender, wrote in his sentencing recommendation.

“To be sure, the jury has determined that much of his astrological work was fraudulent. But it also determined that much was not. Hundreds of thousands of customers, hopeful for magic, came to Patrice Runner for astrological goods and service. Whatever one might say about Mr. Runner’s motivations, it is undisputed that he spent years trying to help them believe they were getting exactly what they wanted,” Darrow wrote.

The defence lawyer’s submission says that Runner, who grew up in an abusive home, used the money to give his children the stability and safety that he never had. Darrow also asks for leniency because of the conditions at the Metropolitan Detention Center, in Brooklyn, N.Y., where Runner has been held for more than three years. Darrow said Runner has become ill, deprived of medical care, held in near solitary confinement and denied the ability to meaningfully participate in his own defence.

Four of Runner’s co-conspirators — two Canadians and two Americans — pleaded guilty in 2018, though only one has been sentenced. Sherry Gore, 73, who prosecutors said managed a process to extract additional money from victims, received two years probation and a $1,000 fine in 2018.

Four people who ran PacNet Services, a British Colombia-based payment processing company used by Runner, and allegedly by other scammers, have been indicted in the state of Nevada by U.S. federal prosecutors, who are seeking their extradition from Canada.

—

通灵诈骗数亿美元 加国男子被判入狱10年

【2024年04月18日讯】(多伦多报导)加拿大男子、蒙特利尔前居民帕特里斯·兰纳(Patrice Runner),历时20年,诈骗金额数亿美元。近日,被美国联邦法院宣判,入狱10年。

根据美国司法部周一(4月15日)公布的公告,兰纳在1994至2014年的20年间,假借通灵者的名义,仅从130多万美国受害者处,就诈取了大约1.75亿美元。

2023年6月,兰纳在美国被判14项罪名成立,包括邮件诈欺和电汇诈欺。

兰纳的欺诈方式是寄信,承诺通灵者将帮助当事人获得财富和幸福,但当事人得付钱。

公诉人在量刑建议中提到,兰纳“每周诈骗7,000多名受害者,无论如何,这7,000多都引人注目”,而这只是他20年来7天期间所进行的诈骗。

57岁的兰纳通过蒙特利尔的一家公司把信件寄给美国和加拿大人。信中假借通灵者玛丽亚·杜瓦尔(Maria Duval)和帕特里克·盖林(Patrick Guerin)的名义,骗取钱财。

兰纳还在多个国家策划这种骗局,后来在西班牙被捕,并于2020年被引渡到美国。

据加通社报导,兰纳的四名同谋,两名加拿大人和两名美国人,已于2018年认罪,但只有一人被判刑。73岁的雪莉·戈尔(Sherry Gore)管理从受害者那里榨取额外金钱的渠道,在2018年被判处两年缓刑和1,000美元罚款。

卑诗省付款处理服务公司PacNet Services的四名经营者,受到美国起诉,美方正在寻求引渡。该服务公司不仅为兰纳,也为其他诈骗者提供服务;去年底,卑诗省充公了从该公司没收的的1,000万元诈骗赃款。

2024.4.16, Colorado funeral home owners accused of mishandling 190 bodies charged with Covid-19 relief loan fraud, officials say

疫情下的火葬詐欺:棄置190具遺體、偽造骨灰,美國殯葬夫妻檔被控重罪

Colorado funeral home owners accused of mishandling 190 bodies charged with Covid-19 relief loan fraud, officials say

The owners of a Colorado funeral home accused of mishandling nearly 200 sets of human remains are now facing charges for allegedly fraudulently obtaining more than $880,000 in Covid-19 relief funds and using it for personal expenses like trips and jewelry, federal prosecutors said.

Jon and Carie Hallford each face federal charges, including 13 counts of wire fraud and two counts of conspiracy to commit wire fraud, the United States Attorney’s Office for the District of Colorado said in a news release Monday.

The Hallfords are accused of using $882,300 in pandemic relief loans meant to help support small businesses on things like “a vehicle, multiple vacations, entertainment, dining, tuition for a minor child, cryptocurrency, cosmetic medical procedures, jewelry” and items from Amazon, an indictment filed in the US District Court of Colorado said.

A judge on Monday scheduled an arraignment for each defendant for Thursday, court records show. An attorney for Carie Hallford told CNN they have no comment. CNN reached out to the Colorado Public Defender’s Office for comment on behalf of Jon Hallford.

The Hallfords also face state charges related to the October discovery in of 190 sets of human remains improperly stored at their Return to Nature Funeral Home in Penrose, Colorado. The facility said it offered “green burials,” without embalming fluid, in a biodegradable casket or “none at all.” Their arraignments on those charges are scheduled for June 6.

Investigators were called to the funeral home after receiving a report of an odor coming from the building, Fremont County officials said at the time.

The Hallfords were arrested in November by the Colorado Bureau of Investigations on 190 counts of abuse of a corpse and counts of theft, money laundering and forgery, according to state charging documents.

They have not yet entered pleas for those charges.

The federal indictment alleges the pair defrauded their funeral home customers by not providing a cremation or burial for the deceased as promised.

“Beginning as early as September of 2019, and continuing through October of 2023, the Hallfords failed to cremate or bury approximately 190 bodies in connection with the scheme,” the indictment said. They allegedly “collected in excess of $130,000 from victims for cremation or burial services which they never provided,” prosecutors allege.

The Hallfords “concealed the gruesome collection of bodies … by preventing outsiders from entering their building, covering the windows and doors of the building to limit others from viewing inside, and providing false statements to others regarding the foul odor emanating from the building and the true nature of the activity occurring inside,” the indictment said.

The Hallfords each face up to 20 years in prison and up to $250,000 in fines if convicted in the federal case, according to the indictment.

Demolition of the funeral home is set to begin Tuesday, the US Environmental Protection Agency said last month.

“Following the assessment, EPA has determined that demolition of the building is necessary to safely remove all residual medical and biological materials found in the building. The cleanup will be conducted under the direction of EPA’s Emergency Response personnel and its trained hazardous materials contractors,” the agency said.

—

Colorado funeral home owners indicted again and back in jail — this time for alleged wire fraud

The married couple who own the Return to Nature Funeral Home in Penrose are back behind bars as the facility where nearly 200 “improperly stored bodies” were discovered last fall will be demolished. Jon Hallford and Carie Hallford have been arrested by the FBI and indicted by the federal government for allegedly defrauding customers and the government.

The Hallfords have each been charged with 10 counts of wire fraud over their alleged failure to bury or cremate bodies of people, despite taking money for the services. They’ve also been accused of making false statements to the U.S. Small Business Administration in their efforts to qualify for three separate loans totaling $882,300.

“Beginning as early as September of 2019, and continuing through October of 2023, the Hallfords failed to cremate or bury approximately 190 bodies in connection with the scheme. As a result, the Hallfords collected more than $130,000 from victims for cremation or burial services which they never provided,” the 19-page federal indictment filed last week reads.

The two appeared in federal court Monday to hear the charges against them. Among the allegations are that they defrauded the government to obtain SBA loans during the pandemic by defrauding the Paycheck Protection Program, which is part of The Coronavirus Aid, Relief, and Economic Security (CARES) Act, obtaining $882,300. The indictment indicates they spent money improperly on, “a vehicle, multiple vacations, entertainment, dining, tuition for a minor child, cryptocurrency, cosmetic medical procedures, jewelry, various goods and merchandise from Amazon, and payments to other vendors unrelated to their business.”

“That’s scamming all of us,” said Abby Swoveland.

The body of her mother Sally was among those found in the building.

“We are all paying that. I am glad he is going to be answering to that. And she is, too”

Swoveland has had a long and difficult six months.

“There was a tremendous amount of shame that I had to work through on my own because I picked them, I chose them and this is what they did,” she explained.

She has been an advocate of changing requirements for funeral home operators and on inspections in the Colorado Legislature.

“And so speaking out had helped me with that.”

Plans to tear the building down are a positive to her, “I think it’s great. It’s a long time coming. It’s time for that building to go. That is going to be I think a cathartic moment for many, many families.”

The funeral home grounds are set to be demolished this week after a ceremony for families of those impacted on Tuesday morning. The process is expected to take about 10 days to complete.

In the latest indictment, the Hallfords are facing 13 counts of wire fraud and aiding and abetting and two additional counts of conspiracy to commit wire fraud. If convicted, they could face up to 20 years in federal prison, up to a $250,000 fine — or a combination of the two — up to 3 years of supervised release and they could be ordered to pay restitution.

The Hallfords are also facing hundreds of charges in connection to the Return to Nature Funeral Home including abuse of a corpse, forgery and money laundering. The couple was arrested in Oklahoma in November 2023.

It was last fall when 190 improperly stored bodies were discovered inside the Return to Nature Funeral Home. The investigation into the funeral home began in early October 2023 when neighbors reported a foul smell to law enforcement.

All decedents were removed from the funeral home on Oct. 13, 2023 and transported to the El Paso County Coroner’s Office. In February, Gov. Jared Polis issued a second Executive Order to provide an additional $220,000 for DNA testing related to the funeral home investigation. Fremont County Coroner Randy Keller said this week that 18 bodies have yet to be identified.

Swoveland and other families hope that the Hallfords face vigorous prosecution as they hope to put this painful chapter behind them, “That’s all we’ve got at this point to hold onto. The victims are just wanting justice. We all want justice. And we all want to see the Hallfords to answer for what they did.”

—

疫情下的火葬詐欺:棄置190具遺體、偽造骨灰,美國殯葬夫妻檔被控重罪

「你本是塵土, 仍要歸於塵土……」美國科羅拉多州2023年爆出大規模「火葬詐欺案」,一家殯儀館數年來收了錢卻沒有火化遺體,不僅偽造證明、給家屬裝有假骨灰的骨灰罈,還將騙來的費用都花在奢侈消費。檢警在當地空屋找到高達190具腐爛遺體,有些至少被棄置4年之久。殯儀館經營者霍爾福夫妻在今年4月15日被控200多項罪名,最高可能判處20年徒刑。主要犯案期間正值疫情高峰,火葬數量攀升、葬禮從簡成為趨勢,卻讓該殯儀館有機可趁,也凸顯該州殯葬法規監管不力。而數百個家庭好不容易從送別親人的悲痛中走出,卻又面臨摯愛遺體毀損、甚至不知所蹤的情況,留下無盡不解與創傷。

2023年10月初,美國科羅拉多州科羅拉多泉市爆出「回歸自然殯儀館」(Return to Nature Funeral Home)火葬詐欺案。法院在4月15日公開起訴文件,經營者霍爾福夫妻喬恩與凱莉(Jon and Carie Hallford)面臨250多項指控,包含190起虐待遺體罪(abuse of a corpse)、5起竊盜罪、4起洗錢罪以及至少50起偽造文書罪等等。檢察官指控夫妻倆不僅沒有依照程序處理遺體,還將至少90萬美元的葬禮費用與疫情紓困金全數花在度假、醫美手術等奢侈用途。

▌大型鑑識團隊出動

根據《美聯社》調查,霍爾福夫妻將本應火化的遺體藏在鄰近的彭羅斯鎮(Penrose),這是個不到4,000人的小鎮,多數居民通勤到科羅拉多泉市上班。2023年10月初,鎮上民眾檢舉當地一棟建築傳出臭味,檢警循線尋獲被棄置的遺體。由於數量太過龐大,科羅拉多州州長波利斯(Jared Polis)還為此發布了口頭災難聲明(verbal disaster declaration),州政府災難應變單位以及3個郡的驗屍官都被動員,連國土安全局(Homeland Security)、聯邦調查局(FBI)都派員參與調查、鑑識和清理,這類團隊通常僅在空難等大型災難才會出動。

FBI探員柯恩(Andrew Cohen)在法庭作證表示,當他們走進藏有遺體的房屋,連身經百戰的鑑識人員都感到心驚。屋內沒有任何冷藏或冷卻設備,遺體如同貨物般層層疊疊,地上屍水累積好幾吋深,大門已透出一個大大的污漬,蒼蠅與蛆蟲更是滿佈整間屋子。柯恩指出,至少可以確認有23具遺體死於2019年、61具遺體死於2020年,當中包括成人、嬰兒與胚胎。

柯恩心有餘悸地說:「那是你會想要忘掉的畫面,但忘不掉。」

時間過去逾5個月,鑑識單位仍在盡力透過DNA、指紋、牙科紀錄或金屬關節等醫療植入物來辨識死者身分。陸續確知身分後,調查單位也一一聯絡家屬,很多人直到接獲通知才知道親人的遺體被棄置到腐爛。有些家屬則是看到新聞後向火化場確認,卻崩潰發現火化證明根本是偽造的,這代表許多家屬當初拿到的骨灰可能不是「自家人」。

根據法務部網站解釋,經焚化爐妥善火葬後的屍骨當中,所有有機體的DNA分子結構已被高溫破壞,所以無法再進行DNA檢驗。這也意味著,如果家屬發現自家親人的遺體尚未火化,很可能永遠無法查出家裡那罐骨灰究竟屬於何者。此外,至少4位死者的家屬也懷疑自家骨灰罈裡裝著「水泥」。當中有2位家屬「敢於求證」,他們拿水混和之後,發現「骨灰」竟然真的凝結成塊。後續調查也顯示,2020至2023年間,霍爾福夫妻從賣場購買了高達600磅(約272公斤)的水泥,可能就是用來偽裝成骨灰。

除了火葬案件之外,FBI還發現其中一具遺體屬於一名前陸軍三等士官長,但該士官長當初舉行的是土葬。調查人員與家屬挖開墳墓後,赫然發現棺材裡躺的是一具女屍。該名士官長已重新舉行軍葬禮並下葬於軍人公墓。檢調此次至少發現2起「埋錯屍體」的情況,但並未披露被錯埋的遺體身分,也不清楚怎麼會發生這種事。

上述種種離譜的發現,引發許多遺屬的震驚與悲痛。福特(Stephanie Ford)表示,丈夫衛斯理(Wesley Ford)生前強調他討厭棺材,因而選擇火化,殊不知丈夫成為被棄置的遺體之一。她在受訪時失聲痛哭:「我知道這不是我的錯,但還是會有罪惡感…我讓他失望了。」威爾森(Tanya Wilson)則在2022年8月依照媽媽遺囑將骨灰撒在夏威夷海裡,警方卻告訴她,她媽媽的遺體自始至終都躺在那棟空屋裡。威爾森表示:「我們以為完成了她的心願,結果我們獲得的所有平靜都被剝奪了。」她也自陳會不斷幻想,母親的遺體如何被堆疊在滿是屍水的陰暗房間裡,深陷在痛苦的想像裡。

另一位母親佩姬(Crystina Page)更在Facebook設立專頁,號召受害家庭團結發聲。佩姬20歲的兒子大衛(David)在2019年被執法單位射殺身亡。佩姬自此投身警界改革的倡議行動,過去4年都抱著兒子的骨灰罈東奔西走,這個紅色骨灰罈陪著佩姬去到科羅拉多州議會、甚至還去過華府,豈知裡面裝的根本不是大衛。

佩姬說:「我兒子就在那裡躺了4年,靜靜腐爛……我這輩子從來沒有過這麼糟的感受。」

▌事跡敗露

整起事件敗露的起點,源自霍爾福夫妻因欠稅而遭驅離,似乎早已面臨嚴重財務危機。曾與殯儀館配合的威爾伯火化場(Wilbert Funeral Services)表示,雙方早在2022年年底終止合作,但殯儀館積欠火化費用將近一年,火化場忍無可忍告上法院,才導致司法介入。但殯儀館在這段期間仍然向外界假裝正常營業,繼續收受遺體、舉辦葬禮,還開立假的火化證明給家屬。《美聯社》記者檢視了部分家屬提供的火化證明,許多日期都是在停止與火化場合作之後。

起訴書指出,從未舉行的火葬和土葬儀式至少為霍爾福夫婦賺進13萬美元,他們還申請了至少3筆貸款與高達88萬2,300元的疫情紓困金,卻不是拿去付清欠款。柯恩探員證稱,霍爾福夫妻花了12萬美元買了一台GMC Yukon大型休旅車和一台日產豪華轎車Infiniti,光是這筆費用就足以付清近400具遺體的火葬費,他們卻選擇任由那190具遺體自行腐爛。夫妻倆也將財產花在孩子的學費與醫美手術等等,購買了逾3萬美元的加密貨幣,還有古馳(Gucci)與蒂芙尼(Tiffany & Co)等名牌精品。

本案另一項疑點之一在於,近200具遺體為何沒有更早引發惡臭或其他衛生問題?但根據《衛報》調查,早在2020年時政府單位曾就接到投訴,有人指控殯儀館「不當存放遺體」,當局僅僅打了一通電話查問,霍爾福夫妻宣稱臭味是來自剝製標本,逃過一次調查機會。而霍爾福夫妻是否有對遺體進行任何除臭處理?抑或躲過了哪些調查與投訴?因為倆夫妻與律師至今不肯接受任何媒體訪問,也還未開始在法庭上答辯,外界仍無法得知更多犯案細節。

不過,媒體調閱法庭證據發現,霍爾福夫妻早在2020年就已開始擔心事跡曝光,討論該如何解決掉眾多遺體。檢察官克拉克(Kevin Clark)在法庭公布兩人簡訊,喬恩曾傳訊給妻子表達擔憂:

「選項A,盡快蓋一個新機器;B,挖個大洞,再倒入鹼液(lye),但要在哪?C,挖個小洞放把大火,但要在哪?D,我去坐牢。這很有可能發生。」

再隔一年,喬恩仍在擔心遺體處置問題,但同時還能思考晚餐吃什麼。他再次於簡訊提到:

「我回家要馬上洗澡,剛剛搬運的時候我被『人汁』(people juice)噴到了。我要吃雙倍起司堡、加生菜、不要番茄,謝謝。」

但最令家屬遺憾、不解的是,霍爾福夫妻儘管擔憂被抓,卻沒有證據顯示他們採取任何實質行動來處理日益腐爛的遺體。長達3、4年的時間,霍爾福夫妻唯一的行動就是這些流露擔憂的簡訊。

▌為何沒被發現?

此案也暴露出,科羅拉多州的殯葬法規過度寬鬆,缺乏實際監督並存在許多漏洞。例如,回歸自然殯儀館的執業登記2022年11月就已過期,卻沒有任何人去檢查或提醒;而且這並非該州第一次發生「水泥冒充骨灰」案件,2023年1月也有一對母女被控沒有依約火化遺體,兩人分別被判20年與15年徒刑。本案爆發後,科羅拉多州去年底也通過新法,讓政府人員不需經過允許就能稽查殯葬單位,但州政府仍然沒有撥出更多預算來支援稽查行動,新規定形同虛設。

根據回歸自然殯儀館Instagram帳號,該館創立於2017年,主打「環保葬」(Green Burial)服務。美國傳統葬禮會為遺體進行防腐處理,以便來賓瞻仰遺容後再行下葬。但近年來隨著地價高漲、物價升高及環保觀念興盛等因素,愈來愈多人選擇不為遺體防腐,棺木也選用易生物降解的材質等。愈來愈多家屬也選擇先火葬,骨灰再採取樹葬、海葬等環保方式,甚至將骨灰罈放在家中緬懷。

不過或許我們仍會出現另一層疑惑,為什麼有這麼多家屬不知道骨灰罈裡裝的是「誰」?或許只能從不同的殯葬文化去理解。台灣普遍的葬禮流程中,告別式之後會直接移靈至火化場,家屬通常會看著逝去親人被推入火化爐,在2小時內完撿骨並拿回骨灰。但美國的火化流程則視家屬而定,看著遺體火化並非預設選項。如果不進行瞻仰儀式,通常會將遺體直接從醫院、家中或安養院運送到火化場,經安排火化之後,火化場員工再將燒完的骨頭碎片磨成細粒狀,由專人或快遞送還給家屬,告別式則是任何時間都能舉辦。因此,家屬確實很可能沒有仔細看過骨灰罈內容物。

而在2020年爆發的COVID-19疫情,更加速推高了火葬趨勢。3年多的疫情造成美國將近120萬人死亡,醫療機構與喪葬機構的量能都一度面臨崩潰,人們被迫不再遵守特定喪葬儀式。例如在疫情初期病毒傳播力仍然很強,染疫患者的遺族不但不能觸碰其遺體,為了安全起見,遺體還要盡速火化;而在火化場吃不消的情況下,許多遺體也被快速掩埋;此外染疫者的遺體使用特製納體袋收容,無法見上最後一面;有些患者死亡時還與家屬分隔兩地,只能立刻火化,種種情況可能都讓家屬難以確認親人遺體的最後下落。

從4月16日開始,聯邦環境保護局展開至少1周的拆除作業,預計將儲藏遺體的房屋夷平。所有遺骸在去年10月13日已經移到其他地點,驗屍官凱勒(Randy Keller)表示鑑識工作仍在持續,目前剩下18位死者尚未確認身分。民眾與家屬也在拆除工作開始之前舉行了一場悼念儀式。凱勒說:「希望儀式能畫下某種句點,為這起恐怖事件的相關受害者帶來一點點撫慰。」

回過頭來,霍爾福夫妻其實早在2019年就開始犯下虐待遺體與詐欺之罪,只是2020年COVID-19疫情大爆發,很大程度上延緩了其罪行被發現的時間,甚至因為社會整體對火葬的接受度變高,可能導致更多人因此受害。然而回歸自然殯儀館遠非個案,科羅拉多州立法與行政部門的怠惰,或許是更值得受到究責與追問的一方。

鑒於本案仍在進行中,法庭上將檢視更多待解的疑問。例如,如此大量的遺體未處理,殯儀館員工應當知情,為何沒有作為?又或者,土葬儀式將遺體調包又是為了什麼原因?諸多問題唯有在霍爾福夫妻配合下,才有機會獲得詳細解答。但無論如何解釋,殯儀館經營者何以能夠一邊安慰家屬、一邊對遺體棄之不顧,而過往還有多少家庭的摯愛親人也遭受這等待遇,恐怕會是受害家屬與數千鎮民心中永遠難以理解的結。

2024.4.16, 81-year-old charged with murder of Uber driver he mistakenly believed was a scammer, police say

据克拉克县治安官办公室称,一名 81 岁的俄亥俄州男子因误认为一名 Uber 女司机与骗子合作并试图敲诈他而开枪射击,因此被控谋杀罪。

81-year-old charged with murder of Uber driver he mistakenly believed was a scammer, police say

An 81-year-old Ohio man is charged with murder after he shot a female Uber driver he mistakenly believed was working with a scammer and attempting to extort him, according to the Clark County Sheriff’s Office.

William Brock shot Loletha Hall several times outside his South Charleston home on March 25, according to a criminal complaint. Hall was taken to a local hospital where she died.

Brock told police that prior to the shooting he had received threatening phone calls from a male caller who claimed one of Brock’s relatives was being held in jail, according to a news release from the sheriff’s office.

The caller then asked Brock to wire money for the relative’s bond, and when Brock resisted, the caller began threatening to harm him and his family.

When 61-year-old Hall arrived in her Uber at Brock’s residence, he shot her multiple times, the release states.

Brock believed Hall had a connection to the scam caller and would kill him and his family, according to a 911 call he made after shooting her, authorities said.

Police released dashcam video obtained from Hall’s vehicle of Brock confronting her outside his home.

‘A horrific tragedy’

Hall received a request on the Uber app to pick up a package from Brock’s residence, the news release states. Authorities believe she was “unfamiliar with the circumstances” surrounding the request.

Hall arrived in her Uber, and dash cam video from her car shows her getting out of the car to speak to Brock.

According to the news release, she made no demands of Brock other than to ask about the package she was sent to retrieve.

Brock was arrested and charged with murder as police saw no active threat presented by Hall during the encounter, and Brock failed to contact authorities for assistance, the sheriff’s office said.

Brock pleaded not guilty to a charge of murder and posted his $200,000 bond on Wednesday, according to court documents.

CNN has reached out to Hall’s family and to Brock’s defense attorney, Paul Kavanagh, for comment.

Uber has been in contact with Hall’s family and law enforcement, the company said. “This is a horrific tragedy and our hearts continue to be with Loletha’s loved ones as they grieve,” an Uber spokesperson said in a statement to CNN.

“We have been in contact with law enforcement and remain committed to supporting their investigation.”

Uber has banned the account of the individual who ordered Hall’s Uber to Brock’s house, the company said. Authorities believe that individual was either the original scam caller or an accomplice, according to the release.

The company says it’s committed to the safety of Uber drivers and has developed safety features including an in-app emergency button, route sharing features and the ability to connect to a live safety agent.

It’s unclear if authorities have identified the owner of the account or made any additional arrests.

CNN has reached out to the Clark County Sheriff’s Office for more information.

—

Uber driver shot and killed by 81-year-old Ohio man after both received scam calls, police say

An 81-year-old Ohio man has been charged with murder after allegedly shooting an Uber driver who thought she was picking up a package from the man’s house. Both appeared to have been victims of scam phone calls, the Clark County Sheriff’s Office said in a news release.

The Uber driver, Loletha Hall, was found shot multiple times near 81-year-old William Brock’s South Charleston home on March 25. Brock, who had called 911, had an injury to his head and ear and was bleeding when police arrived, according to a police report.

Hall, a Black woman, was taken to a hospital in Dayton, where she died of her injuries.

Investigators discovered that Brock had earlier received a scam call about an incarcerated relative, which had involved threats and demands for money.

An unknown man told Brock over the phone he needed to pay $12,000 to get his nephew out of jail, according to a police report. Brock told police the caller threatened to kill him and his nephew if he didn’t pay the ransom, the report said.

The same caller, or an accomplice, later hired Hall using the Uber app to pick up a package from Brock’s residence, according to investigators. Hall was not aware that Brock had been threatened, the sheriff’s office. said.

“Ms. Hall, suffering from medical conditions and unarmed, made no threats or assaults toward Mr. Brock, and made no demands, other than to ask about the package she was sent to retrieve,” the sheriff’s office said.

Brock allegedly held Hall at gunpoint and demanded to know the identities of the people who had called him. He also took Hall’s phone and refused to allow her to leave, officials said, adding that Brock did not try to call police at this point.

When Hall tried to get back into her vehicle, Brock allegedly shot her, and there was a “subsequent scuffle at the door of Ms. Hall’s vehicle,” the sheriff’s office said. Brock then allegedly shot her two more times, before calling 911.

Brock is charged with murder, which carries a penalty of 15 years to life in prison, court records showed. Police are considering other charges. Brock pleaded not guilty, and bail was set at $200,000, court records showed.

Officials are still searching for the scam callers.

“The Clark County Sheriff’s Office would like to take the opportunity to again remind residents, especially our older citizens, that no Law Enforcement Agency or Court will make contact with anyone in the manner of this case to solicit cash for bail,” the office said, urging residents “to use extreme caution when being contacted unexpectedly by subjects claiming to be relatives incarcerated in a correctional facility.”

2024.4.10, East Hampton Police say two New Yorkers were arrested last week after an investigation revealed they allegedly scammed an East Hampton resident out of more than $100,000 in gold.

2 charged with scamming East Hampton man out of $100K in gold

美國紐約州(New York)2名華人男子被提告盜竊罪。

EAST HAMPTON, Conn. (WTNH) – East Hampton Police say two New Yorkers were arrested last week after an investigation revealed they allegedly scammed an East Hampton resident out of more than $100,000 in gold.

According to police, the resident was scammed by someone who identified himself as a Homeland Security agent who claimed to be collecting a debt the victim owed, in gold.

The fraudulent agent set a time during with the gold would be picked up at the victim’s home.

While undercover at the victim’s home on the morning of April 4, the officers apprehended the suspects.

Fei Fei Jiang, 29, of Queens, New York, and Ya Lou Wang, 36, of Flushing, New York were both charged with first-degree larceny and first-degree conspiracy to commit larceny.

Neither suspect was able to post his bond- Jiang’s was $500,000 and Wang’s was $750,000. Both suspects appeared at the Middletown Superior Court on April 5, according to police.

Police said they were able to recover and return the victim’s more than $100,000 in gold.

—

假冒國安部人員騙價值10萬黃金 紐約2華裔非法移民被捕

美國紐約州(New York)2名華人男子,日前謊稱是國土安全部人員,在康乃狄克州(Connecticut)試圖騙取價值10萬元以上的黃金,遭到警方逮捕,指控兩項一級盜竊罪。據悉,兩人都是無證移民,案件仍在調查中。

康乃狄克州電視台《WTNH》報導,居住在紐約州皇后區59街的29歲男子蔣飛飛(Fei Fei Jiang,音譯),和居住在法拉盛的36歲男子王亞樓(Ya Lou Wang,音譯),近日來到康州度假時,謊稱是國土安全部人員,欺騙一位民眾他欠下一筆巨額債務,需用價值10萬元黃金償還,並和對方約定取款時間。

康乃狄克州東漢普頓(East Hampton)警方接獲報案,4日上午8時30分左右來到受害者住所附近進行臥底行動,在兩名華人男嫌前來取款時,當場將他們逮捕。

調查發現,兩人都是無證移民,被提告一級盜竊罪(first-degree larceny)和共謀犯一級盜竊罪(conspiracy to commit first-degree larceny),保釋金分別為50萬美元和75萬美元,由於兩人都無力支付,目前被關押在哈福特懲教中心(Hartford Correction Center)。

—

假冒国土安全部特工诈骗黄金 纽约两华男康州被捕

两名住在纽约市王后区的华人男子冒充国土安全部(DHS)特工,企图诈骗一名康州居民价值10万美元的黄金,4月4日遭到康州警方逮捕。

这名康州东汉普顿(East Hampton)居民日前接到一名自称国土安全部特工的男子的通知,称该居民欠了一大笔债务,需要用黄金偿还,并约定时间要到居民家中来取。4月4日上午8点30分,两名华男上门时被卧底的警察逮捕。警方调查后,将价值超过10万美元的黄金归还给该居民。

两名被捕的华男分别为:现年29岁、住在王后区的江飞飞(Fei Fei Jiang,音译)和现年36岁、住在法拉盛的王亚楼(Ya Lou Wang,音译),他们都是无证移民,被控犯有一级窃盗罪和共谋一级窃盗罪。两人于4月5日在米德尔敦(Middletown)高等法院过堂,江飞飞的保释金定为50万美元,王亚楼的保释金定为75万美元,两人都无法缴纳,继续还押。

2024.4.12, Riverside deputies arrest ‘fake priest’ wanted across the U.S.

Riverside deputies arrest ‘fake priest’ wanted across the U.S.

羅斯塔斯被指控冒充「馬丁神父」搶劫天主教堂。河濱縣警局

Deputies in Moreno Valley say they’ve arrested a “fake priest” wanted by authorities across the country.

Various law enforcement agencies across the U.S. have been on the lookout for 45-year-old Malin Rostas, who also goes by the name Moyse Lingurar.

He’s accused of posing as a priest, calling himself “Father Martin,” and using deception to steal from churches.

On Wednesday, Riverside County Sheriff’s Department deputies in Moreno Valley located a vehicle on the 10000 block of Pigeon Pass Road that matched the description of the one used by Rostas.

The driver identified himself as Father Martin, and the Sheriff’s Department said he had just attempted to steal from a local church.

Rostas, a New York resident, was taken into custody and booked into the Robert Presley Detention Center in Riverside on an outstanding felony warrant out of Pennsylvania.

Additional charges are expected to be filed for the attempted burglary in Moreno Valley, officials said.

The Riverside County Sheriff’s Department believes there may be additional burglary victims. Anyone with information regarding this case or similar cases is encouraged to contact the Moreno Valley Sheriff’s Station at 951-486-6700.

—

詐騙盜竊全國通緝 「假神父」南加落網

南加州內陸執法單位宣布一名經全國通緝、在各地教會盜取現金的「假神父」終於在莫雷諾谷落網。

《洛杉磯時報》報道,河濱縣縣警局指出,一名臭名昭著的假神職人員在全國各地教會進行詐騙竊盜,他最終在河濱縣被捕及面臨審判。

調查人員指出,幾個月來,被指控自稱「馬丁神父」的羅斯塔斯(Malin Rostas)穿著黑色服裝,出現在美國和加拿大各地天主教堂,自稱是「來自芝加哥的訪問神父」。

但調查人員表示,當信任他的東道主將他獨自留在教堂旁的私人住所時,羅斯塔斯便會趁機搜刮貴重物品,然後夾帶現金匆忙逃逸。

3月,紐約皇后區美國烈士羅馬天主教堂的雷達爾(Peter Raydar)神父遭盜九百元,他說:「他是一隻禿鷹,來到神聖教會行騙並侵犯所有人,這是非常可悲。」

雷達爾坦言,羅斯塔斯事前已做足功課,知道教會內人員的名字,他能使用教會詞彙,知道在何處能找到有價值的物品。

羅斯塔斯被指控在休士頓的一座教堂犯下類似罪行,據稱騙取五百元。當局表示,懷疑他從俄勒岡州一座教堂盜竊1700多元。

去年10月,斯托克頓教區也曾發出警告,聲稱兩名男子冒充墨西哥托盧卡真牧師的身份,向多數移民教區居民收取高昂費用,以進行即興儀式:洗禮、堅信禮、第一次聖餐。

正如教區發言人向《國家天主教紀事報》所描述的那樣,「披著羊皮的狼」甚至開始要求教區居民提供出生證明副本,引發教友對身份盜竊和可能人口販運的擔憂。

邁阿密教會官員近期警告信徒,假神職人員偽裝進行虛假儀式,以換取蓄有現金的iTunes禮品卡,一名教友被騙1500元。

類似詐騙情況變得猖獗,迫使當地大主教不得不在電視上發言提醒,儘管神父在彌撒期間傳遞募捐盤索情況很常見,但沒有天主教牧師會向教區教友索要禮品卡。

最近一起牧師騙局則發生在沙加緬度,當時一間小型快餐店連鎖店因違反勞動法而受到聯邦調查,店主曾僱用一名假神父來聽取員工認罪。該名假神父沒有讓員工審視靈魂並反思罪惡,而是不斷地將談話引向她的工作表現:詢問是否遲到、從餐廳偷過東西或做了任何傷害雇主的事情。

河濱縣警局表示,他們注意到羅斯塔斯的汽車與一系列入室盜竊案中所使用的車輛描述相符,最終發現45歲的紐約人羅斯塔斯是可疑車輛駕駛,在針對逮捕令進行例行檢查後,很快意識到面對的是被全國通緝、被指控為小偷的「假神父」。

羅斯塔斯因在賓州未執行的重罪逮捕令而遭關押在河濱市的羅伯特普雷斯利拘留中心。據治安部門指出,執法單位預計很快會對他提出更多的指控。洛杉磯訊

羅斯塔斯被指控冒充「馬丁神父」搶劫天主教堂。河濱縣警局

—

Nationwide manhunt for a fake priest who stole faith as well as cash ends in Moreno Valley

A notorious fake priest who left a trail of doubt and disbelief among the faithful he’s accused of swindling from coast to coast will soon face judgment in Riverside County, sheriff’s officials say.

For months, Malin Rostas, accused of calling himself “Father Martin,” allegedly donned black garb and showed up at Catholic churches across the U.S. and Canada claiming to be “a visiting priest from Chicago,” according to investigators.

But when his all-too-trusting hosts would leave him alone in the rectory — a priest’s personal quarters next to the church — investigators say Rostas would rifle through their valuables and make a hasty exodus with their cash.

In March, Father Peter Raydar, of the American Martyrs Roman Catholic Church in Queens, N.Y., got burned for $900.

“He’s a vulture, he’s a vulture,” Raydar told a local TV station. “It’s very sad that someone is going to come to any house of worship and just violate everybody.”

But, Raydar confessed, the alleged fake priest had done his homework. He’d learned the names of people at the church, used ecclesiastical vocabulary and knew where to find the loot, he said.

Rostas is accused of pulling a similar caper at a church in Houston, allegedly making off with $500. And authorities say they suspect him in the theft of more than $1,700 from a church in Oregon.

There’s nothing new about diabolical scammers posing as men of the cloth, of course.

In October, the Diocese of Stockton issued a warning about two men who had assumed the identities of real priests in Toluca, Mexico, and were charging mostly immigrant parishioners exorbitant fees to perform impromptu rituals: baptisms, confirmations, first Communions.

The “wolves in sheep’s clothing,” as a diocese spokeswoman described the men to the National Catholic Register, also started demanding copies of the parishioners’ birth certificates, raising fears of identity theft and possible human trafficking.

In Miami, church officials recently warned the faithful about fake priests performing bogus rituals in exchange for iTunes gift cards loaded with cash. One parishioner was duped for $1,500.

It got so bad, the local archbishop had to go on TV and remind his flock that, although it is common for priests to pass around the collection plate asking for money during Mass, “no Catholic clergyman will ask a parishioner for a gift card.”

But perhaps the most inspired recent priest scam occurred in Sacramento, when the owners of a small chain of taquerias that was under federal investigation for labor law violations hired a fake father to hear employees’ confessions.

“I found the conversation to be strange and unlike normal confessions,” one of the servers later told investigators.

Instead of giving her space to search her soul and reflect on her sins, the fake priest kept steering the conversation to her job performance: asking if the server ever showed up late, stole from the restaurant or did anything to harm her employer.

For “Father Martin,” the reckoning arrived Thursday morning in Moreno Valley in the form of Riverside County sheriff’s deputies who said they noticed his car matched the description of a vehicle used in a string of burglaries.

Behind the wheel they found Rostas, 45, of New York. After running a routine check for arrest warrants, they quickly realized they were face to face with what so many had been searching for — the man accused of being the pilfering padre.

Rostas was booked at the Robert Presley Detention Center in Riverside on an outstanding felony warrant from Pennsylvania. More charges are expected to be filed soon, according to the Sheriff’s Department.

2024.4.9,紐約長島再現電信詐欺案 2華人嫌犯遭逮捕。經調查,納蘇郡警察局逮捕了來自皇后區的47歲陳榮(Rong Chen,音譯)和來自賽奧塞(Syosset)的46歲余振生(ZhenSheng Yu,音譯)。他們均被提告重竊罪,並已於近日受到審訊。

據悉,近來在紐約周邊地區發生多起類似案件。上月,一名來自長島谷流(Valley Stream)的67歲老人,在發現電腦出現技術問題,撥打一位「技術代表」的電話,並向這位技術代表支付3萬2500元現金以期解決問題,警方隨後逮捕了報住在曼哈頓的43歲黃維序(Weixu Huang,以下均為音譯)和報住在布碌崙(布魯克林)的41歲游永梅(Yongmei You)。

紐約長島再現電信詐欺案 2華人嫌犯遭逮捕

紐約長島納蘇郡(Nassau County)近日逮捕2名涉嫌電信詐欺老人的華裔男嫌,金額超三萬元,2人都被提告重竊罪(Grand Larceny),警方提醒民眾對此類詐騙提告警惕。

根據警方,今年1月,一名來自納蘇郡馬鞍石(Saddle Rock)的83歲男性受害者在電腦上收到一則設備遭到破壞的通知,他需要聯繫電腦屏幕上的號碼尋求幫助;於是他按照指示撥打後,對方聲稱他為微軟(Microsoft)工作,他告知該男性受害者,其手機和銀行帳戶發現了可疑活動,需要支付1萬6000元現金來解決問題。

該男性受害者照做後,一名不明男子在1月19日上門收走了這筆錢;次日,該受害者接到另一名男子的電話,指示他再取1萬5000元現金,當男子前來收錢時,受害者通知了警方。

經調查,納蘇郡警察局逮捕了來自皇后區的47歲陳榮(Rong Chen,音譯)和來自賽奧塞(Syosset)的46歲余振生(ZhenSheng Yu,音譯)。他們均被提告重竊罪,並已於近日受到審訊。

據悉,近來在紐約周邊地區發生多起類似案件。上月,一名來自長島谷流(Valley Stream)的67歲老人,在發現電腦出現技術問題,撥打一位「技術代表」的電話,並向這位技術代表支付3萬2500元現金以期解決問題,警方隨後逮捕了報住在曼哈頓的43歲黃維序(Weixu Huang,以下均為音譯)和報住在布碌崙(布魯克林)的41歲游永梅(Yongmei You)。當地警方因此敦促社區保持警惕,並提醒易受騙的家庭成員、朋友和鄰居注意可能的詐騙或欺詐行為。

—

83-year-old targeted in Long Island Microsoft scam

Two people allegedly bilked him out of $31,000 before he figured out what was going on, police say

Four people have been arrested in the past two weeks for allegedly pulling off very similar scams on Long Island. It’s not clear if the cases are connected, but one of the victims who lives in Great Neck wants others to be aware that anyone can fall for the ploys. NBC New York’s Pei-Sze Cheng reports.

Authorities arrested two people in connection with a tech scam that targeted an 83-year-old Long Island man, Nassau County police said Tuesday — and some of the claims against the suspects are remarkably similar to other recent incidents.

The alleged crime in question dates back to mid-January but the defendants, 47-year-old Rong Chen of Fresh Meadows and 46-year-old ZhenSheng Yu of Syosset, were arrested Monday. Yu was arraigned Tuesday on grand larceny charges, and pleaded not guilty. Chen was arraigned on the same charges a day before.

The pair is accused of scamming a Great Neck man out of $31,000.

According to detectives, the duo sent a popup notification to the victim’s computer around 1 p.m. on Jan. 18 indicating that the device had been compromised and he should call the provided number on the screen for assistance.

“They were very convincing,” said the victim, who did not wish to be identified. “Something flashing on my computer screen that said ‘your computer is completely locked,’ and a [phone] number flashed on the screen.”

When he called the number, the person who answered the phone claimed to work for Microsoft and told the victim suspicious activity had been detected on his phone and personal bank account. The individual asked the 83-year-old to withdraw $16,000 in cash to rectify the problem. The victim complied, and a man showed up to collect the funds the next day.

The day after that, they bilked him again — this time for $15,000 — with the same ruse.

“They said one was for buying guns and one for gambling,” said the victim. “Both are for federal crimes, so before you know, [the] FBI is going to come and arrest you.”

While the victim did not purchase guns or gamble, he said the speaker was very convincing. To confirm what had been said to him over the phone, the victim called his bank.

“When I called my bank to check on that, apparently they hacked my phone and rerouted to their own personnel. They said those amounts were missing and I had to replace it,” the man said.

Yu was seen on cellphone video at the victim’s house allegedly making a pickup.

Police say the victim was contacted again, but he had wisened up to the scam by the third contact. He refused to comply and called the police, who came to his Nassau County home to make the arrests.

Information on possible attorneys for Yu and Chen wasn’t immediately available.

Those were the most recent arrests in a troubling string of scams. On Saturday, 39-year-old Xiuyu Dong, of Brooklyn, was charged for attempting to scam a Manhasset woman out of $10,000. Prosecutors alleged the victim was contacted by the so-called fraud department of a bank, and that if she did not pay she would be arrested by the FBI and that “snipers” were outside of her house.

In the first week of April, 31-year-old Yongkang Weng, also of Brooklyn, was arrested before he could steal $30,000 from a 67-year-old woman after falsely telling her that she owed that money from a gambling debt.

Police declined to speak to NBC New York regarding the most recent alleged scam, but the victim said this can happen to anyone and he hopes others will learn from his loss.

“The cops should find out who is the mastermind of this thing and go after them,” the victim told News 4.

Anyone with information on the scam — or believes they may have been a victim — is urged to call Nassau County Crime Stoppers at 1-800-244-TIPS.

—

83-year-old Long Island man scammed out of $32K in elaborate computer scam

SADDLE ROCK, Long Island (WABC) — An 83-year-old Saddle Rock man was scammed out of nearly $32,000 as part of an elaborate scheme by two men who claimed to work for Microsoft and told him his computer had been compromised.

Police say the victim got a notification on his computer on Jan. 18 that his device was compromised and he needed to contact the number on the screen for assistance.

The suspect told the victim that he worked for Microsoft and there was suspicious activity on his phone and his personal bank account.

The victim was told he needed to withdraw $16,000 in cash to fix the problem and complied with the request on Jan. 19.

Then, police say, the victim was contacted again for an additional $15,000 in cash and a second man collected the money on Jan. 20.

When the victim was contacted a third time, he refused to comply and contacted police.

After an investigation, authorities arrested 47-year-old Rong Chen and 46-year-old ZhenSheng Yu on Monday. They are both charged with grand larceny.

Nassau County police are urging the community to be alert and to remind vulnerable family members, friends and neighbors about potential scams or fraud.

Anyone with additional information is asked to contact Nassau County Crime Stoppers at 1-800-244-TIPS or call 911. All callers will remain anonymous.

2024.4.4,谷歌起诉加密诈骗者涉嫌将虚假应用程序上传到 Android 应用商店

谷歌周四对一群加密货币诈骗者提起诉讼,指控他们在全球范围内诈骗了超过 10 万人。

谷歌表示,它是同行中第一个对加密货币诈骗者采取行动的公司。

该公司旨在利用诉讼作为制定法律先例的方式来保护其用户。

不再容忍上傳假App至應用商店 谷歌提告加密貨幣詐騙集團

谷歌周四 (4 日) 對一群加密貨幣詐騙者提告,指控他們在 Google Play 上傳欺詐性投資和加密貨幣交易應用程式,欺騙了全球超過 10 萬人。

谷歌表示,它是第一家對加密貨幣詐騙者採取行動的科技公司,這樣做是為了建立法律先例,為用戶提供保護。訴訟指出,被告「為了將其欺詐性應用程式上傳到 Google Play,向谷歌做出多次虛假陳述,包括不限於對其身份、位置以及所上傳應用程式的類型和性質的虛假陳述」。

這家 Alphabet (GOOGL-UD) 旗下的公司正在根據詐騙者影響和腐敗組織 (RICO) 法案提起民事索賠,並對詐騙集團提出違約索賠。該公司表示,該詐騙集團創立並發布至少 87 個欺詐應用程式來欺騙用戶。

谷歌總法律顧問普拉多 (Halimah DeLaine Prado) 接受《CNBC》採訪時表示:「這對我們來說是一個獨特的機會,可以利用我們的資源來實際打擊不良行為者,這些不良行為者正在運行廣泛的加密貨幣計劃來欺騙我們的用戶。」

她說,「光是 2023 年,美國就有超過 10 億美元的加密貨幣詐欺和騙局,這次訴訟不僅能夠利用我們的資源來保護用戶,而且還為我們未來的不良行為者提供了先例。不能容忍這種行為。」

該訴訟在紐約南區提出,被告分別為 Yunfeng Sun (又名 Alphonse Sun) 和 Hongnam Cheung (又名張洪寧,Zhang Hongnim) 或費雪 (Stanford Fischer),至少從 2019 年起就開始詐騙。訴訟指出,兩名被告透過三種方法誘騙受害者從 Google Play 和其他來源下載應用程式,使用 Google Voice 向主要在美國和加拿大的受害者發送簡訊,並在 YouTube 和其他平台上傳宣傳影片以及支付用戶佣金的聯盟行銷活動用於註冊人員。

訴訟稱,Sun、張及其代理人將這些應用程式設計得看來合法,向用戶說明他們正在維持應用程式上的餘額並賺取投資回報。然而,用戶無法撤回他們的投資或聲稱的收益。

訴訟指出,為了讓用戶相信這些應用程式是值得信賴的,被告允許用戶最初提取少量資金。據了解,其他人被告知需要支付費用或達到最低餘額才能提取資金。谷歌說這種策略「騙走一些受害者更多的錢」。

—

Google sues crypto scammers for allegedly uploading fake apps to Android app store

•Google filed a lawsuit on Thursday against a group of crypto scammers, alleging they defrauded more than 100,000 people globally.

•Google says it’s the first among its peers to take action against crypto scammers.

•The company aims to use the litigation as a way to set legal precedents to protect its users.

Google filed a lawsuit on Thursday against a group of crypto scammers, alleging they defrauded more than 100,000 people across the globe by uploading fraudulent investment and crypto exchange apps to Google Play.

Google says it’s the first tech company to take action against crypto scammers, and is doing so as a way to set a legal precedent to establish protections for users. The lawsuit claims the defendants made “multiple misrepresentations to Google in order to upload their fraudulent apps to Google Play, including but not limited to misrepresentations about their identity, location, and the type and nature of the application being uploaded.”

The Alphabet-owned company is bringing civil claims under the Racketeer Influenced and Corrupt Organizations (RICO) law as well as breach of contract claims against the group of scammers, who the company said created and published at least 87 fraudulent apps to dupe users.

“This is a unique opportunity for us to use our resources to actually combat bad actors who were running an extensive crypto scheme to defraud some of our users,” Halimah DeLaine Prado, general counsel at Google, told CNBC Crypto World in an exclusive on-camera interview.